...声远导读:桑之未|9月豪华车市场销量环比上涨15%,“金九银十”如期而至,豪华suv销量排行榜 桑之未|9月豪华车市场销量环比上涨15%,“金九银十”如期而至,豪华suv销量排行榜:豪华suv销量排行榜,豪华车销量,suv销量排行榜,销量,中型suv销量排行榜,合资suv销量排行榜,20万suv销量排行榜,轿车销量排行榜,女士suv销量排行榜... |

撰稿人 / 桑之未

汽车流通行业分析师 | 中国汽车流通协会专家委员会成员

(This article is attached with English translation)

【本文关键词】豪华车市场/经销商销量/市场份额/平均售价/折扣率

这是2019年第9篇豪华车市场分析报告,往期报告可通过公众号底部菜单「月度报告」获取,感谢您的关注!

导语:9月,社会零售总额中汽车类为3397亿,同比下滑2.2%,环比增长11.3%;其中笔者调研的豪华车零售总额为1089亿,同比增长4.2%,环比增长14.5%,占比32.1%,环比增加1个点。从收入角度看,豪华车销售从7月份开始触底反弹,恢复增长,10月份因国庆假期有效销售日期减少,预计销量与收入将有所降低。

▼9月豪华车市场销量环比上涨15%

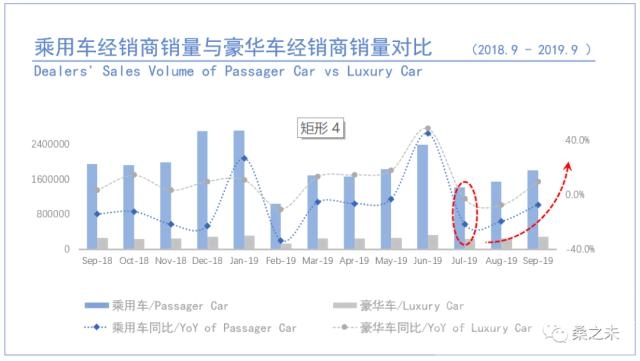

1-9月国内乘用车经销商零售累计销量为1607.5万辆,同比下滑2.3%;其中1-9月20个豪华品牌经销商零售销量为230.8万辆,同比增长10.6%。

第三季度国内乘用车经销商零售销量为476.9万辆,同比下滑16%,环比下滑18.8%;其中9月国内乘用车经销商零售销量为180.7万辆,同比下滑7.3%,环比增长16.6%;第三季度20个豪华品牌经销商零售销量为76.6万辆,同比下滑0.2%,环比下滑8.6%;其中9月豪华车经销商零售销量为28.3万辆,同比增长9.8%,环比增长15%。“金九银十”是国内汽车传统销售旺季,汽车零售逐步开始恢复增长。

去年进口车关税下调,经过7、8月份进口车销量增长,9月销售回落,基数较低;今年6月清理国五车型,7月销量达到今年低点后,销量开始回升,9月销量获得同比15%的增长;从季度销量看,去年和今年均受到政策影响,不过去年是减少关税,属于积极影响,今年是清国五,对市场是消极影响。

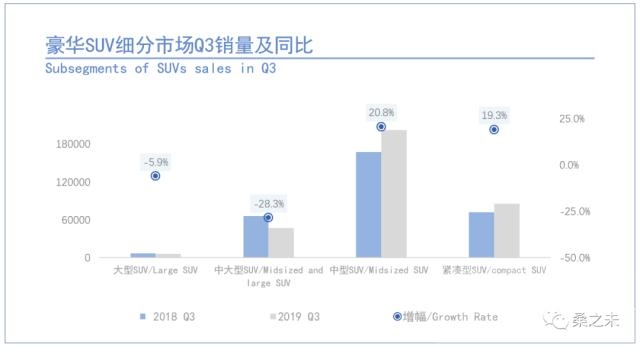

▼第三季度豪华SUV市场销量增长9.5%,轿车下滑11.6%

第三季度,豪华SUV市场销量增长9.5%,其中,中型SUV市场增长20.8%,紧凑型SUV增长19.3%,主要是X3、XT4、XC40等新车型有所贡献;大型SUV市场下滑28.3%。

豪华轿车细分市场销量下滑11.6%,其中,大型轿车市场下滑17%,中型轿车市场下滑16.3%,中大型轿车市场下滑8%,主要是宝马新3系换代,奥迪A6L销量爬升,以及凯迪拉克ATS-L、XTS国六后续车型还没有上市等因素所致。

从全年累计数据看细分市场,豪华SUV市场销量增长15.9%,轿车市场销量增长3.1%。

▼9月豪华车折扣较上月下滑1.17%,经销商库存维持在合理区间

9月,豪华车整体市场折扣较上月下滑1.17%,主要受奥迪、宝马折扣下滑影响;加之9月市场客流与上月比较仅增长0.06%,在客流增长有限的情况下,市场价格压力比较大,折扣下行也较为正常;本月奥迪折扣较上月下滑1.5%,宝马折扣较上月下滑1%,奔驰折扣增长0.1%,沃尔沃折扣下滑0.5%,林肯、英菲尼迪折扣下滑均超过1%。

9月车企对经销商返利较上月减少0.31%,自6月国五清库后,车企逐渐收窄对经销商返利支持力度,返利水平逐月恢复至正常水平;本月豪华车整体市场均价涨至38.9万元,较上月上涨4000元,豪华车销售质量进一步转好。

9月,豪华车整体市场库存深度较上月增长0.13个点,整体库存维持在1.5左右,库存处于合理范围内。奔驰、宝马、奥迪、捷豹路虎等经销商库存维持在1.3左右,低于行业均值;凯迪拉克、沃尔沃、林肯经销商库存较高,其中沃尔沃、林肯经销商库存超过2.0,较上月增加0.8个点,价格压力较大,经销商需要注意风险。

9月作为季度销售最后一个月,又是传统的“金九银十”汽车销售季的开始,车企与经销商均比较重视;进入10月受国庆假期影响,并且有效销售日期减少,各家车企销售进度较慢;一线城市如北京、上海等城市受假日影响较大,车企需要关注这些城市经销商库存状况。

▼9月豪华车市占率为15.7%,环比下降0.2个点

9月,豪华车市占率为15.7%,较上月下降0.2个点;其中奥迪经销商零售市占率为24.1%,较上月增长1.8%;奔驰市占率为22.8%,较上月下滑3.2%;宝马市占率为22.6%,较上月增加0.1%。本月奥迪销量增长较多,市占率份额增加较大,奔驰相对8月份额下滑较大。

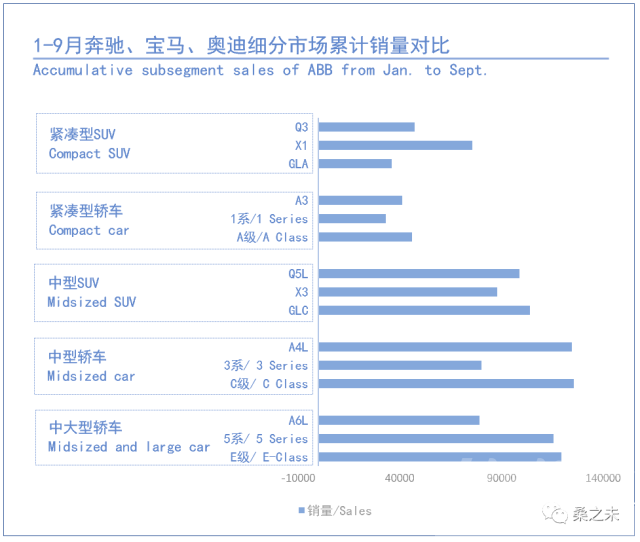

9月奔驰、宝马、奥迪三家车企销量占豪华车整体销量的72.1%;第三季度这一数字是72.4%;1-9月份三家车企销量占整体销量的70.8%。ABB今年销量占比的进一步提升,对其他二线豪华品牌的销售产生一定的压力,二线豪华品牌需要进一步明确自己的产品定位,加大自己的产品与ABB同价位产品的差异化,而那些与ABB产品重叠度较高的品牌,不可避免地卷入与ABB的价格竞争。

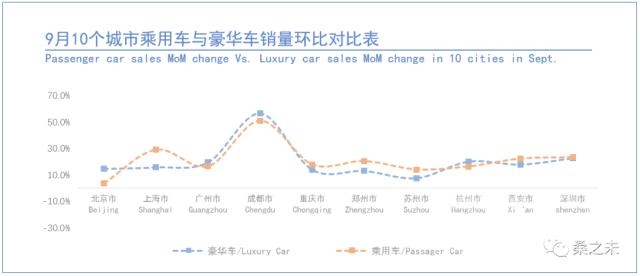

▼9月10城市豪华车销量同比增长20.3%,销售回暖

第三季度,国内十个区域中心城市乘用车销量为118.8万辆,同比下滑18.8%,其中9月销量为46万辆,同比增长20.7%;第三季度十个区域中心城市豪华车销量为27万辆,同比下滑3.3%,其中9月销量为10.3万辆,同比增长20.3%。从城市来看,北京、上海、深圳受限于限购,仅保持个位数增长,其他城市豪华车全年累计销量均保持两位数增长。

(10城市:北京、上海、广州、深圳、成都、重庆、郑州、苏州、杭州、西安)

链接 第三季度美国豪华车市场增长0.13%

第三季度,美国10个豪华品牌销量为42.9万辆,同比增长0.13%,其中奔驰季度同比增长15.4%,销量为89,636辆,在美豪华车销量排名第一;宝马同比增长6%,销量为75,987辆;雷克萨斯同比下滑6.1%,销量为73,816辆;奥迪同比下滑4.1%,销量为57,031辆;特斯拉同比下滑20%,销量为54,700辆,因政府补贴取消所致,1-9月特斯拉在美国市场累计销售13.86万辆,同比增长15.51%。

▼ 奔驰(含smart)

9月,奔驰(含Smart)经销商销量为6.5万辆,同比增长8.5%;第三季度销量为19万辆,同比增长7.6%;1-9月累计经销商销量为5.6万辆,同比增长4.1%。

9月,奔驰品牌新车均价维持在46.1万元左右,较上月上涨1.78万元;新车折扣较上月增加0.1个点,截止9月份经销商库存深度在1.3左右;奔驰在豪华车中的市占率为22.8%,较上月下滑3.2个点。

9月,奔驰“800年款”车型逐步进入销售,“800年款”车型改进车机系统,增加远程控车功能。第三季度,奔驰销售速度加快,主力车型C级、E级、GLC同比增长均超过10%,进口车主力车型GLE同比增长12%,S级增幅高达42.5%。其中,9月两款进口车主力车型销量均超过2000辆,GLE销量增长43.5%,S级销量增长86.4%。

▼ 宝马(含MINI)

9月,宝马(含MINI)经销商销量为6.6万辆,同比增长12.1%,第三季度销量为18万辆,同比下降2.4%,1-9月累计经销商销量为5.5万辆,同比增长17.8%。

9月, 宝马品牌新车均价维持在40.1万元左右,较上月上涨0.96万;新车折扣较上月下滑1个点;截止9月份经销商库存深度在1.3左右,市占率为22.6%,较上月增加0.1个点。

9月,宝马新3系仍处在爬坡阶段,经销商零售在0.65万辆左右,新车折扣下滑7个点,宝马3系价格将会持续下探,月销过万辆后,价格将会稳定;宝马5系(含混动)零售1.64万辆,宝马X3零售1.1万辆,宝马X1本月换代零售0.86万辆,X7销量获得较大增幅,销量突破900辆。

9月,宝马两款主力销售车型,宝马新3系销量爬坡,X1面临中期改款,对宝马的批售产生一定的影响,销量压力集中在宝马1系、5系,X3上,导致整体价格受压向下,折扣下滑1个点。10月份,随X1、X2上市,以及宝马320低功率版以及330的推出,3系产品线会进一步丰富,对其销量提升也有很大的帮助。

▼ 奥迪

9月,奥迪经销商销量为6.8万辆,环比增长24.3%,第三季度销量为17万辆,1-9月累计经销商销量近50万辆,同比增长4.4%。

9月, 奥迪品牌新车均价维持在29.9万元左右,较上月下滑0.26万;经销商客流增长3.7%,好于市场整体水平;截止9月份经销商库存深度在1.4左右;市占率为24.1%,较上月增加1.8个点,连续两个月市占率上涨超过1个点。

9月, 奥迪Q5L销量突破1.66万辆,同比增长52.5%,第三季度销售4.1万辆,同比增长23.8%;这是新Q5L上市以来首次单月销量突破1.6万辆,也是首次季度销量增长超过20%。9月,奥迪A4L、A6L、Q5L三款主力车型销量维持在1.5万辆左右,基本恢复到以往销量水平;下一步奥迪需提升Q3、A3的销量。

▼ 凯迪拉克

9月,凯迪拉克经销商销量为1.6万辆,同比下降12.2%,第三季度销量为4.1万辆,同比下降17.1%,1-9月累计经销商销量为16.6万辆,同比增长10%。

9月, 凯迪拉克品牌新车均价维持在29.9万元左右,较上月下滑0.7万;新车折扣接近20个点;截止8月份经销商库存深度在1.8,较上月增加0.4,说明厂家恢复对经销商的压库;市占率为5.7%,较上月增加0.2个点。

9月,凯迪拉克主力车型为XT5、XT4,两款车型销量接近9800辆;上市三个月的6座SUV XT6较上月下滑2个点,折扣5个点左右。9月经销商客流环比下滑5.9%,经销商销量压力较大。

▼ 雷克萨斯

9月,雷克萨斯经销商销量为1.7万辆,同比增长9%,第三季度销量为5.1万辆,同比增长10.7%,1-9月累计经销商销量为14.8万辆,同比增长27.2%。

9月,雷克萨斯品牌新车均价在43万元左右,新车提价后,对其整体价格上涨有一定支撑作用。9月经销商零售数量为1.7万辆,同比增长9%。9月雷克萨斯调整新车售价,部分车型指导价上涨1万多,这在豪华车企中比较少见。雷克萨斯新车定价一直没有太多溢价,今年汇率波动较大,对其利润有一定影响,此次涨价可以看作是应对汇率变化的一种调整。

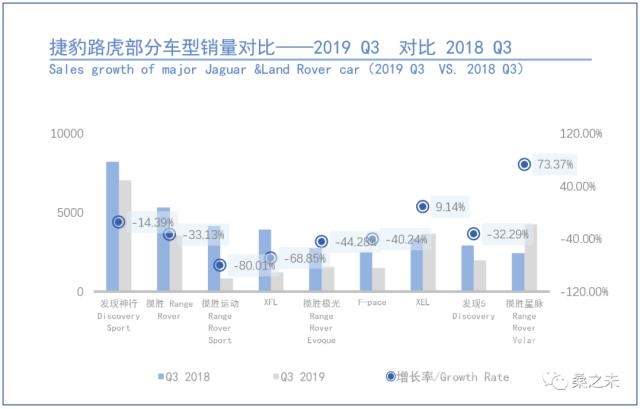

▼ 捷豹路虎

9月,捷豹路虎经销商销量为1万辆左右,环比增长30.4%,第三季度销量为2.6万辆,1-9月累计经销商销量为8.2万辆。

9月,据捷豹路虎官方销量数据显示,9月捷豹路虎在华销量同比增长18%,第三季度同比增长 24%;在 2019 年第三季度里,捷豹路虎的零售表现分别在7月同比增长40%,8月同比增长17%,9月同比增长18%,实现连续三个月的两位数增长;与此同时,经销商库存保持稳定而健康的合理水平,整个经销商网络平均盈利情况也实现了扭亏为盈。

▼ 沃尔沃

9月,沃尔沃经销商零售数量为1.6万辆,同比增长27.6%;第三季度销量为4.1万辆,增长14.8%,1-9月累计经销商销量为11.1万辆,同比增长21.8%;9月XC60增长18.7%,S90增长52%,达到0.42万辆,XC90增长51%,销量达到0.21万辆。9月经销商库存增长较快,折扣下滑较大,经销商需要注意控制风险。

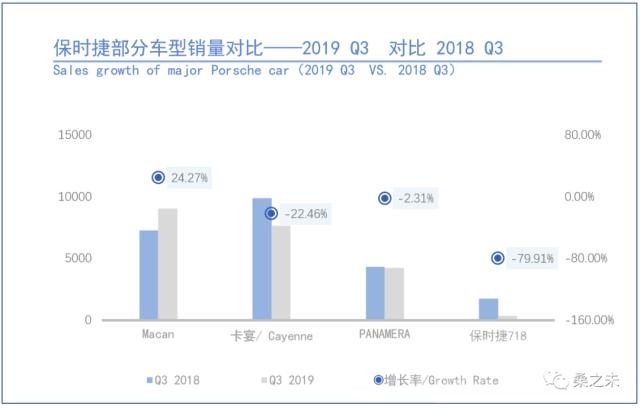

▼ 保时捷

9月,保时捷经销商零售数量为0.8万辆,同比增长3.4%;第三季度销量为2.2万辆,同比下滑6.8%,去年同期受进口车关税下调影响,基数较高,1-9月累计经销商销量为6.6万辆,同比增长23.9%。

▼ 林肯

9月,林肯经销商零售数量为0.43万辆,同比下滑20%,去年同期受进口车关税下调影响,基数较高;11月份新款飞行家上市,有望提振林肯今年销量。

▼ 英菲尼迪

9月,英菲尼迪经销商零售数量为0.39万辆,同比下滑6.6%;英菲尼迪新车型较少,QX50已经成为其销量主力。

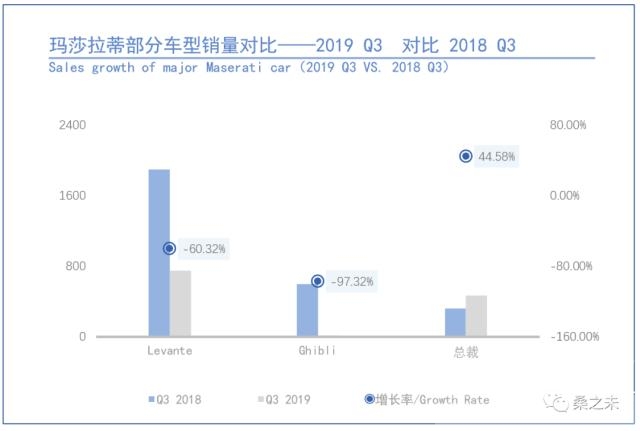

▼ 玛莎拉蒂

9月,玛莎拉蒂经销商零售数量为430辆,同比下滑54.4%。

▼ 讴歌

9月,讴歌经销商零售数量为970辆,同比增长2.8%。

链接

9月,劳斯莱斯销量为107辆;

9月,宾利销量为72辆;

9月,兰博基尼销量为44辆;

9月,阿斯顿马丁销量为39辆;

9月,特斯拉销量5980辆,同比增长273%,第三季度销量突破1万辆,同比增长229%,前9个月累计销量35,820辆;

9月,蔚来销量为2014辆,前9个月累计销量12,257辆。

版权声明:本文系@桑之未 #原创首发# 转载或改编请与本人沟通,如有任何侵权行为,侵权者将承担相应的法律责任。2019-10-21

【往期精选内容】

★ 豪华车月度报告:

8月客流开始恢复正增长,豪华车市场开始温和反弹

7月销量与折扣双触底,豪华车市场即将展开反弹

上半年豪华车市场恢复两位数增长,经销商在厂家返利支持下利润回升

★ 高层领导专访:

对话贝思格:新生代车型在中国取得成功,中国对数字体验需求全球最高

对话保时捷严博禹:三管齐下布局未来 全新Taycan预订令人满意

对话奔驰段建军:上半年销售稳中求进 推出《服务公约》再造服务流程

★ 行业热点分析:

从“车盖女神”到“4S店车闹” 过度维权恐得不偿失

吉利收Smart意在奔驰,戴姆勒借势启动第二家合资公司

大众首提股比提升 奔驰、丰田跟进通用、福特暂无计划

Sang Zhiwei: Luxury car market sales in September rose 15% MoM. Sales peak season bloomed as scheduled.

Written by / Sang Zhiwei

Insight into the Chinese Luxury Car Market

Report | Data | Consulting

Keywords:Luxury car market, Sales volume of dealer, Market share,Average selling price,Discountrate

This is the 9th luxury car market analysis report in 2019. The previous report can be obtained through the bottom menu "Monthly Report", thank you for your support!

In September, the total retail sales of automobiles were 339.7 billion, down 2.2% YoY and up 11.3% MoM. The total retail sales of luxury car were 108.9 billion, up 4.2% YoY and 14.5% MoM, which accounted for 32.1% of the share. From the perspective of sales revenue, luxury car sales began to bottom out from July and resumed growth. Due to National Day holiday in October, the effective sales days decreased. Sales and revenue are expected to decrease.

▼ Luxury car market sales in September rose 15% MoM

From January to September, the cumulative dealer sales volume of domestic passenger car was 16.075 million, down 2.3% YoY. Among them, the dealer retail sales of 20 luxury brands were 2.308 million with an increase of 10.6% YoY.

In Q3, the dealer sales volume of domestic passenger car was 4.769 million, down 16% YoY and 18.8% MoM. Among them, the dealer retail sales of domestic passenger car in September was 1.807 million, down 7.3% YoY and up 16.6% MoM. In Q3, dealer retail sales of 20 luxury brands reached 766,000, down 0.2% YoY and 8.6% MoM. Among them, the dealer retail sales of luxury car in September was 283,000 with an increase of 9.8% YoY and a 15% increase MoM. It is always the peak season in September and October for auto sales in China. Retailing is gradually beginning to resume growth.

Last year, the import tariffs of imported cars reduced. After the sales of imported cars increased in July and August, the sales dropped resulting in a low base in September. After the clearance of models with National V emission standard in June this year, sales in July reached a low point. Sales began to rebound. It has achieved a YoY growth of 15%. In terms of quarterly sales, both last year and this year were affected by the policy. But last year it was a reduction in tariffs, which was a positive impact. However, it is the clearance of models with National V emission standard, which has a negative impact on the market.

▼Luxury SUV market sales increased by 9.5% with car market sales fell by 11.6% in Q3

In Q3, sales of luxury SUVs increased by 9.5%, of which mid-sized SUV market grew by 20.8%. Compact SUVs increased by 19.3%, mainly contributed by new models such as X3 and XT4, XC40. Large SUV market fell by 28.3%.

Luxury car market fell by 11.6%, of which the large car market fell by 17%, the mid-sized car fell by 16.3%, and the medium and large car market fell by 8%, mainly due to the replacement of the BMW 3 Series, the sales of the Audi A6L, and Cadillac ATS-L. The follow-up models of XTS 6 have not been launched.

From the accumulated data of market segments, the sales volume of luxury SUV market increased by 15.9%, and the sales volume of car market increased by 3.1%.

▼Luxury car discount in September fell by 1.17% compared with previous month. Dealer inventory remained at a reasonable range

In September, the overall market discount of luxury cars fell by 1.17%, mainly due to the decline in Audi and BMW discounts. In addition, showroom traffic in September increased by only 0.06% compared with previous month. Under the limited growth of showroom traffic, the market price pressure is relatively large. Discounts are also relatively normal. Audi discounts fell 1.5% this month. BMW discounts fell 1%. Mercedes-Benz discounts rose 0.1%. Volvo discounts fell 0.5%. And Lincoln and Infiniti discounts fell more than 1%.

In September, the rebates from OEMs to dealers decreased by 0.31% compared with previous month. Since the clearance of models with National V emission standard in June, the auto companies gradually narrowed their support for dealer rebates. The rebate level returned to normal month by month. The average price rose to 389,000RMB, up 4,000RMB MoM. The quality of luxury car sales improved further.

In September, the overall market inventory depth of luxury cars increased by 0.13% compared with previous month. The overall inventory remained at around 1.5. The inventory was within reasonable zone. Mercedes-Benz, BMW, Audi, Jaguar Land Rover and other dealer inventory remained at around 1.3, lower than the industry average. Cadillac, Volvo, Lincoln dealer inventory was higher exceeding 2.0 with an increase of 0.8%. The price pressure is high. Dealers need to pay attention to the risks.

September is the last month of quarterly sales. It is also the beginning of the traditional sales peak season. OEMs and dealers pay more attention to it. In October, affected by the National Day holiday, the effective sales days reduced. The sales pace is relatively slow. The market competition is not intense.

▼ The market share of luxury cars in September was 15.7%, down 0.2% compared with previous month.

In September, the market share of luxury cars was 15.7%, down 0.2% compared with previous month. Among them, the dealer retail market share of Audi was 24.1%, up 1.8% compared with previous month. The market share of Mercedes-Benz was 22.8%, down 3.2% compared with previous month. The market share of BMW was 22.6% with an increase of 0.1%. Audi sales and market share increased significantly. Mercedes-Benz's share fell sharply in August. In September, the sales of Mercedes-Benz, BMW and Audi accounted for 72.1% of the total sales of luxury cars. In Q3, it was 72.4%.

From January to September, the sales of ABB accounted for 70.8% of the total sales. ABB's sales volume this year has further increased, which has exerted certain pressure on the sales of other second-tier luxury brands. Second-tier luxury brands need to further clarify their product positioning and increase the differentiation of their products with ABB's products at the same price. Those brands who has high product overlap with ABB are inevitably involved in price competition with ABB.

▼ Top 10 cities luxury car sales in September increased by 20.3% YoY.

In Q3, the sales volume of passenger cars in top 10 cities in China was 1.188 million, down 18.8% YoY, of which sales in September were 460,000 with an increase of 20.7%. In Q3, the sales of luxury cars in top 10 cities were 270,000, down 3.3% YoY, of which sales in September were 103,000 with an increase of 20.3%. From the perspective of the city, Beijing, Shanghai, and Shenzhen are limited by the purchasing restriction, and only maintain single-digit growth. The cumulative sales of luxury cars in other cities have maintained double-digit growth throughout the year.

(10 cities: Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, Zhengzhou, Suzhou, Hangzhou, Xi'an)

Link US luxury car market grew by 0.13% in Q3

In Q3, sales of 10 luxury brands in the United States were 429,000, up 0.13% YoY, of which Mercedes-Benz increased by 15.4% YoY, with sales of 89,636, ranking first in the US luxury car sales. BMW increased 6% YoY. sales were 75,987. Lexus fell 6.1% YoY. Sales volume was 73,816. Audi fell 4.1% YoY. Sales volume was 57,031. Tesla fell 20% YoY. Sales volume was 54,000, due to the cancellation of government subsidies. Tesla has a total sales of 138,600 YTD in the US market with an increase of 15.51% YoY.

▼Mercedes (including Smart)

In September, the average price of Mercedes-Benz brand new cars remained at around RMB 461,000, up by RMB17,800 MoM. The discount on new cars increased by 0.1%. The inventory depth of dealers was around 1.3 in September. The market share was 22.8%, down 3.2% compared with previous month.

In September, the Mercedes-Benz ‘800 version’ model gradually entered sales. The ‘800 version’ model improved the car system and increased the remote-control function. In Q3, Mercedes-Benz's sales speed accelerated. The main models C, E and GLC increased by more than 10% YoY. The imported model GLE increased by 12% YoY. The S-class growth rate reached 42.5%. Among them, in September, the sales volume of the two imported car main models exceeded 2,000, GLE sales increased by 43.5%, and S-class sales increased by 86.4%.

▼BMW (including MINI)

In September, the average price of BMW brand new cars remained at around RMB 401,000, up by 9,600 compared with previous month. The discount on new cars fell by 1% compared with previous month. The inventory depth of dealers was around 1.3 in September. The market share was 22.6% with an increase of 0.1% compared with previous month.

In September, BMW's new 3 Series is still in the climbing stage. The dealer retail sales are around 6,500. The discount of new cars is down by 7%. The price of BMW 3 Series will continue to drop. After monthly sales of over 10,000, the price will be stable. BMW 5 Series (including 530Le) retail sales of 16,400, BMW X3 retail 11,000, BMW X1 facelifted retail sales of 8,600 this month. X7 sales have increased significantly, sales exceeded 900.

In September, BMW 3 Series continued to climb. The X1 facelifted in mid-October, which made the sales ratio of various models of BMW difficult. The sales pressure was concentrated on the BMW 1 Series, 5 Series and X3, which also led to the overall BMW brand. The discount fell by 1%. In October, with the launch of X1 and X2, and the launch of the BMW 320 low-power version and the 330, the 3 Series product line will be further enriched, which will also greatly help its sales increase.

▼Audi

In September, the average price of Audi brand new cars remained at around RMB 299,000, down 2,600 compared with previous month. The discount on new cars fell by 1.5%, among which Audi A6L, Q5L and Q3 further discounted. Showroom traffic increased by 3.7%, better than the overall level of the market. As of the end of September, the inventory depth of dealers was around 1.4. The market share was 24.1% with an increase of 1.8% compared with previous month. The market share increased by more than 1% for two consecutive months.

In September, Audi Q5L sales exceeded 16,600 with an increase of 52.5% YoY. Sales of 41,000 in Q3, up 23.8% YoY. This is the first time that new Q5L has sold more than 16,000 per month since its launch, which is also the first quarter sales growth exceeded 20%. The sales of the three main models of Audi A4L, A6L and Q5L are maintained at around 15,000, and the sales of Q3 and A3 need to be further improved.

▼Cadillac

In September, the average price of Cadillac brand new cars remained at around RMB 299,000, down RMB7,000 compared with previous month. The discount for new cars was close to 20%. The depth of dealers' inventory in September was 1.8 with an increase of 0.4 compared with previous month, indicating that the manufacturers resumed the pressure on dealers. The market share was 5.7% with an increase of 0.2% compared with previous month.

In September, the main models of Cadillac were XT5 and XT4. The sales of two models were close to 9,800. The XT6 of the six-seats SUVs that were launched for three months fell by 2% compared with previous month, with a discount of about 5%. In September, showroom traffic fell by 5.9% MoM, and dealer sales pressure was relatively high.

▼Lexus

In September, the average price of Lexus brand new car was about RMB430,000. After the price increase of the new car, it will have a certain supporting effect on the overall price increase. The retail sales of dealers in September was 17,000 with an increase of 9% YoY. In September, Lexus adjusted the price of new cars. The price of some models increased by more than RMB10,000. This is relatively rare among luxury OEMs. Lexus's new car pricing has not had much premium. This year's exchange rate fluctuates greatly, which has a certain impact on its profit. This price increase could be treated as an adjustment to deal with exchange rate changes.

▼Jaguar Land Rover

In September, according to Jaguar Land Rover's official sales data, sales of Jaguar Land Rover in China increased by 18% in September and 24% in Q3. In Q3 of 2019, Jaguar Land Rover's retail performance shows that 40% increase in July, 17% increase in August and 18% increase in September, achieving double-digit growth for three consecutive months. At the same time, dealer inventory remained stable and healthy, and the average profitability of the entire dealer network also achieved a turnaround.

▼Volvo

In September, Volvo dealers retailed 16,000, up 27.6% YoY. 41,000 units sold in Q3, up 14.8%. XC60 increased 18.7%, S90 increased 52% to 4,200, XC90 growth 51%, sales reached 2,100. In September, dealer inventory grew faster, discounts fell, and dealers needed to pay attention to controlling risks.

▼Porsche

In September, the dealer retail volume of Porsche was 8,000, up 3.4% YoY. The sales volume in Q3 was 22,000, down 6.8% YoY. In the same period last year, it was affected by the tariff cuts of imported vehicles, and the base was higher.

▼Lincoln

In September, the dealer retail sales of Lincoln dealers were 4,300, down 20% YoY. In the same period last year, the tariffs of imported cars were lowered, and the base was high. The new AVIATOR in November are expected to boost Lincoln's sales this year.

▼Infinit

In September, Infiniti dealer retail sales of 39,900, down 6.6% YoY.

▼Maserati

In September, Maserati dealers sold 430 units, down 54.4% YoY.

▼Acura

In September, the dealer retailed 970 Acura cars with an increase of 2.8% YoY.

Link

In September, Rolls-Royce sold 107 units.

In September, Bentley sold 72 units.

In September, Lamborghini sold 44 vehicles.

In September, Aston Martin sold 39 vehicles.

In September, Tesla sold 5,980 units with a YoY increase of 273%. In Q3, sales exceeded 10,000 with an increase of 229% YoY. The cumulative sales in the first nine months were 35,820.

In September, NIO sold 2014 units and accumulated sales of 12,257 in the first nine months.

copyright statement: This article is anoriginal article published by Sang Zhiwei for the first time. For reproduction or adapting, please communicate with the author. In case of any infringement, the infringer will bear the corresponding legal responsibilities. Oct. 21th, 2019, Beijing.

MORE READING

Showroom traffic began to recover in August. Luxury car market began to rebound.

Sales and discount rate all landed in July. The luxury car market is about to rebound.

The luxury car market resumed double-digit growth in 2019H1. Dealers’ profit increased under the support of subsidy from OEMs.

Luxury car market returned to double-digit growth in May. OEMs increased subsidy to clear inventory with national V emission standard. Customer flow recovered to positive growth.

| ...百度一下:桑之未|9月豪华车市场销量环比上涨15%,“金九银十”如期而至 声远论坛 + 大济宁 关注的[车友茶座]... |

|