撰稿人 / 桑之未

洞察中国豪华车市场

报道 | 数据 | 咨询

This article is attached with English translation

【关键词】豪华车市场,经销商销量、市场份额、平均售价、折扣率

豪华车市场成为乘用车市场中最具增长前景的细分市场

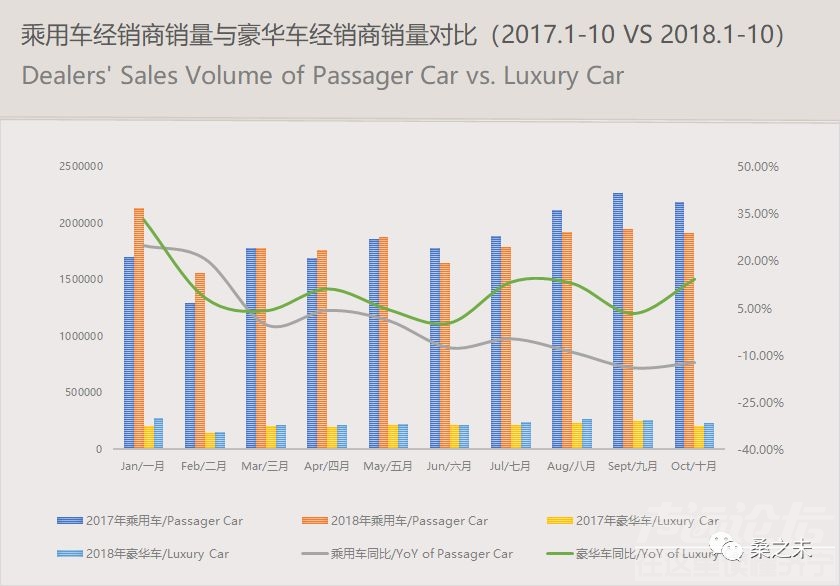

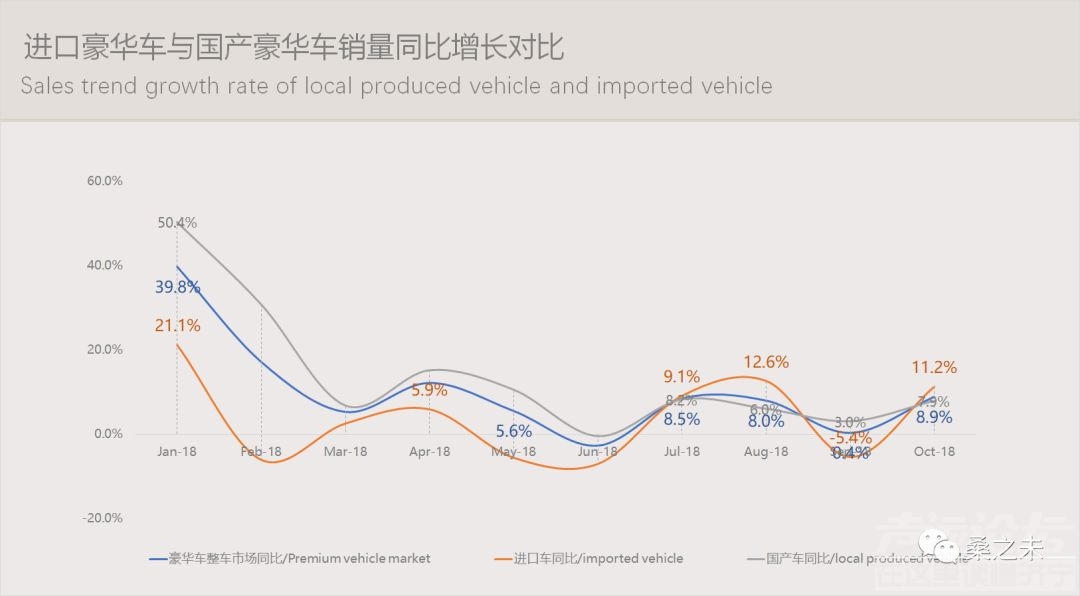

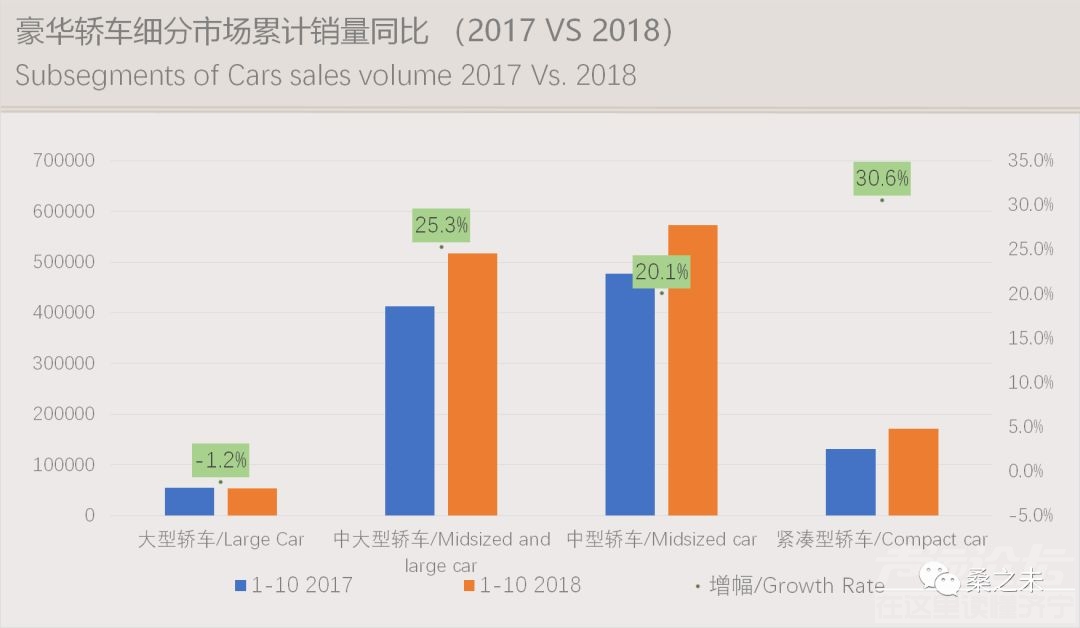

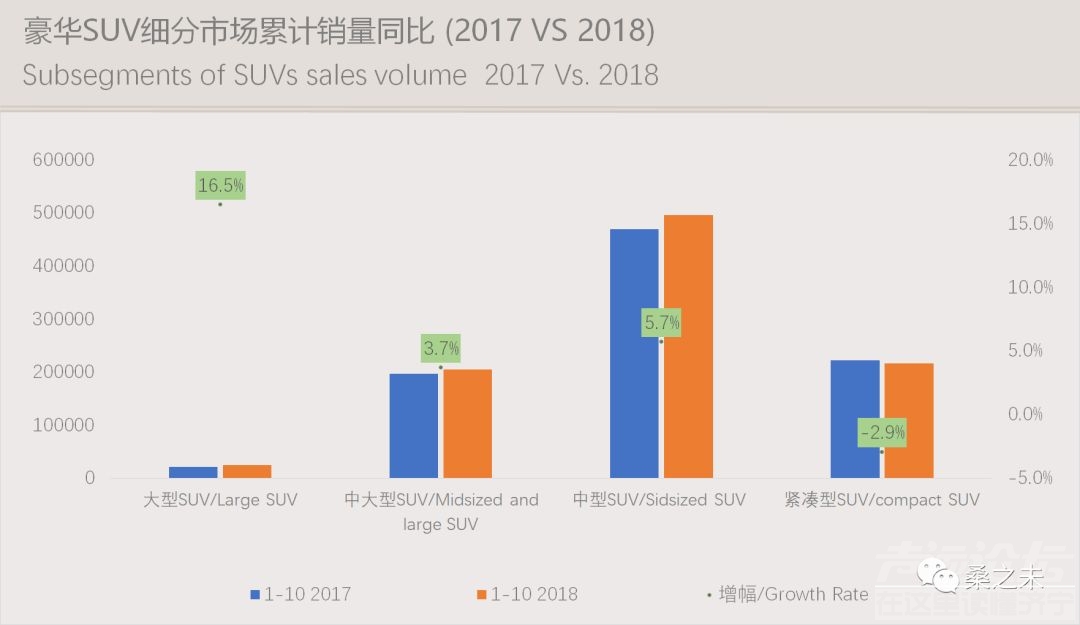

10月国内乘用车市场经销商累计销量首次步入负增长,社会消费品零售总额汽车类累计也首次进入负增长;截止到10月份,豪华车经销商零售累计与去年同期比较仍然保持11.5%的增长,在乘用车市场中属于增长较快的细分市场;这是因为国内豪华车具有定价优势,通过加大折扣方式,逐渐进入中高级合资品牌价位区间,挤压了合资公司中高级车型的生存空间;另外近两年投放的新车型,进入销售增长期,带动了豪华车整体销量的增长。

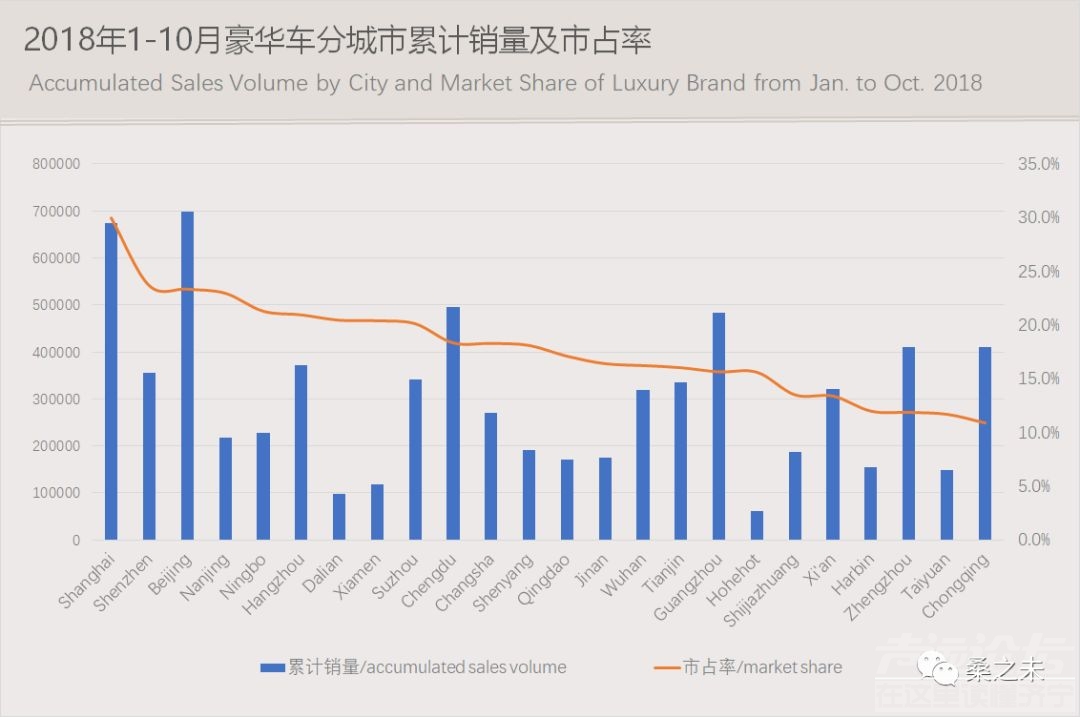

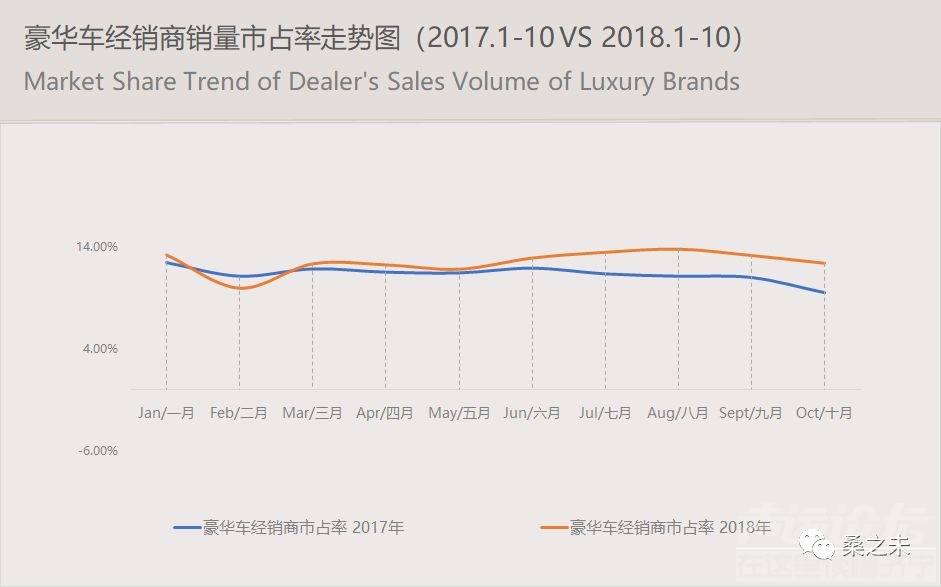

未来数年豪华车将会继续保持稳定的增长,今年前十个月豪华车经销商零售市占率为12.7%,成熟市场豪华车市占率一般会接近25%,未来增长空间比较大;国内1-10月豪华车零售市占率超过25%的城市只有上海,达到29.9%;北京、深圳、南京豪华车市占率在23%上下,杭州、大连、厦门、苏州四个城市豪华车市占率在20%左右;共计20个城市豪华车市占率超过12.7%,跟上了今年豪华车整体市占率的节奏;这20个城市前十个月累计销量为117万辆,占豪华车市场销量的50%,豪华品牌车企如果在这20个城市的销售跟上了节奏,今年的整体销售业绩也不会太差。

国家不救市 但应该梳理清除阻碍汽车消费、流通的政策

今年大宗耐用消费品销售低迷,汽车是最为典型,每当汽车销售低迷,汽车行业就会有让国家救市的声音,近期发改委表示不会救市,市场低迷的主要原因是“前期实施小排量乘用车购置税优惠政策导致部分消费需求提前释放,国际国内经济形势变化在一定程度上影响市场预期等,都对近期汽车产销形成了一定影响,加上“去年同期基数较高,我国汽车产销规模居世界首位,持续快速增长有一定难度。”实际已经否认了国家会“救市”的说法。

如果单纯提供“购置税减半”这种救市方式,已经没有多大效果,前两年这项政策实施已经提前透支了消费。应该从梳理阻碍汽车消费、流通的政策入手,比如二手车限迁,二手车临时产权、二手车交易税费改革、解除部分城市限牌、限号等,以及推出低利率、低手续费的汽车消费信贷等等。

汽车社会消费品零售总额首次步入负增长

据国家统计局数据口径,10月份社会消费品零售总额汽车类3,254亿元,同比下滑6.4%,连续六个月下滑,1-10月累计3.1万亿元,同比下滑0.6%,全年汽车类零售总额首次进入负增长,这在近几年都是比较少见的。其中笔者统计的10月份豪华车零售总额近964亿,占汽车类零售总额的29.6%,环比上个月下滑1.2个点。1-10月份豪华车累计零售总额接近1万亿,占汽车类零售总额的31%。

10月豪华车零售增长11.3%,量与价均进入平稳期

经销商零售口径:10月,全国乘用车经销商零售量为192万辆,同比下滑12%,连续5个月下滑;1-10月累计销量1838万辆,同比下滑1.2%,这也是今年首次经销商累计销售进入负增长。

10月,豪华品牌经销商零售近24万辆,同比增长11.3%,市占率为12.3%。1-10月豪华车经销商零售累计233万,同比增长11.5%,市占率为12.7%,市占率同比增长1.5个点。

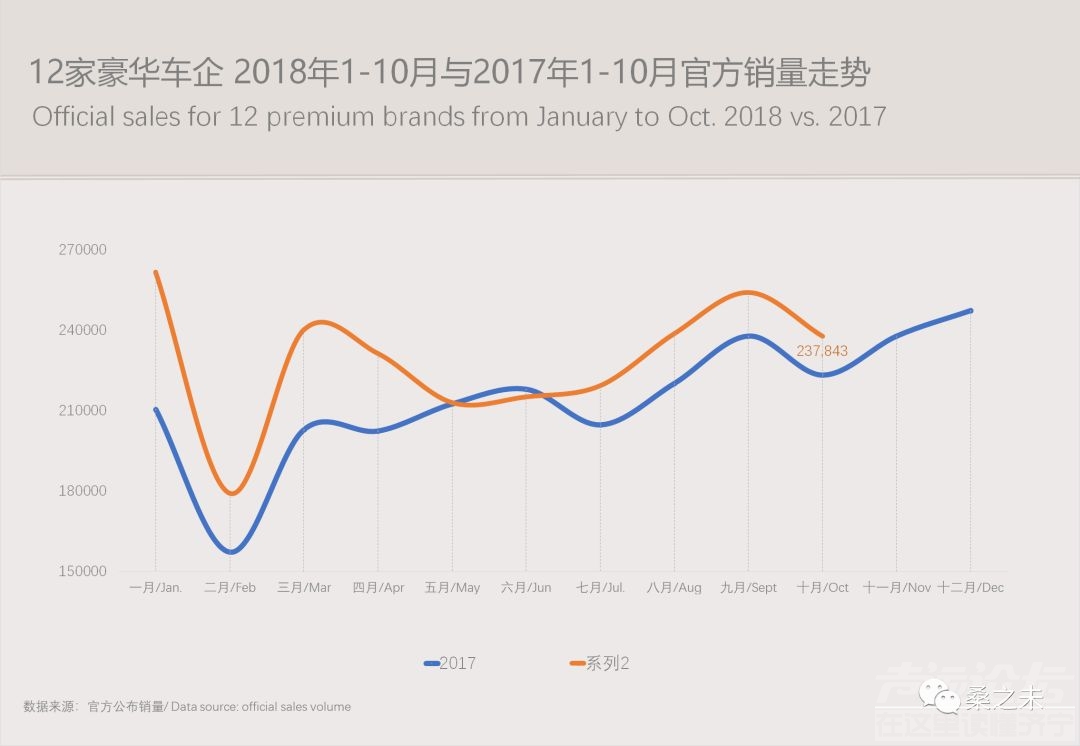

豪华车企官方销售口径:10月,12个豪华车品牌车企官方销量为23.8万辆,同比增长6.5%,环比下滑6.4%。1-10月累计销量为230.8万辆,累计同比增长10.2%。

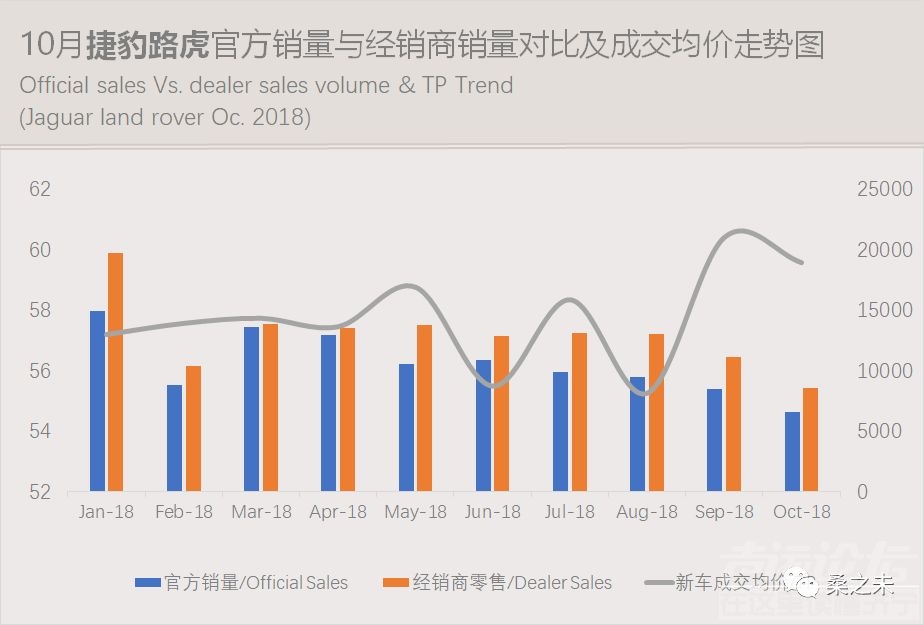

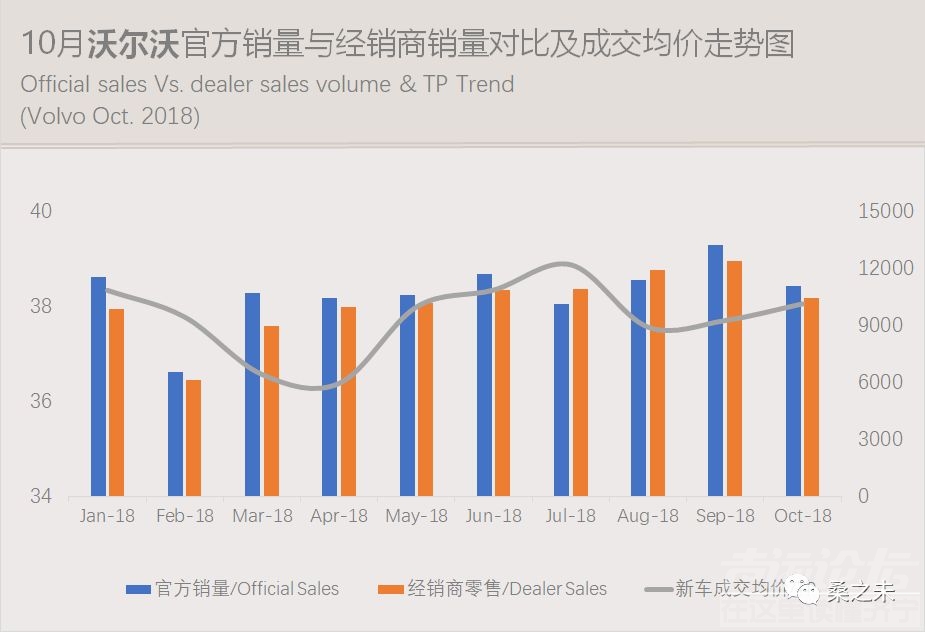

从价格角度看:10月豪华车整体市场折扣率环比下滑0.2%,10月没有金九银十,车企也没有向经销商压库,所以10月份零售市场价格相对稳定。从品牌方面看,捷豹、路虎零售折扣有所回升,林肯、沃尔沃、玛莎拉蒂等品牌整体折扣有所加大。

从客流与库存角度看:通过对经销商调研,10月客流与去年同期比有所下滑;奥迪、奔驰、捷豹路虎、沃尔沃等品牌客流环比下降超过2%,宝马、雷克萨斯、林肯、英菲尼迪等品牌客流保持微增。去年10月市场流传“购置税减半”的政策即将取消,对购车消费者影响较大,加之金九银十是传统销售旺季,带动了整体客流的增长,今年无此利好,部分透支消费的影响已经显现。

10月经销商库存与上月持平,相对比较合理,库存超过1.6的品牌有奥迪、捷豹路虎、凯迪拉克、林肯、沃尔沃等,其中林肯、沃尔沃库存居前超过1.8。10月,奥迪、宝马微升,奔驰新款C、新款GLCL10月上市,开始陆续铺货,经销商库存微降。

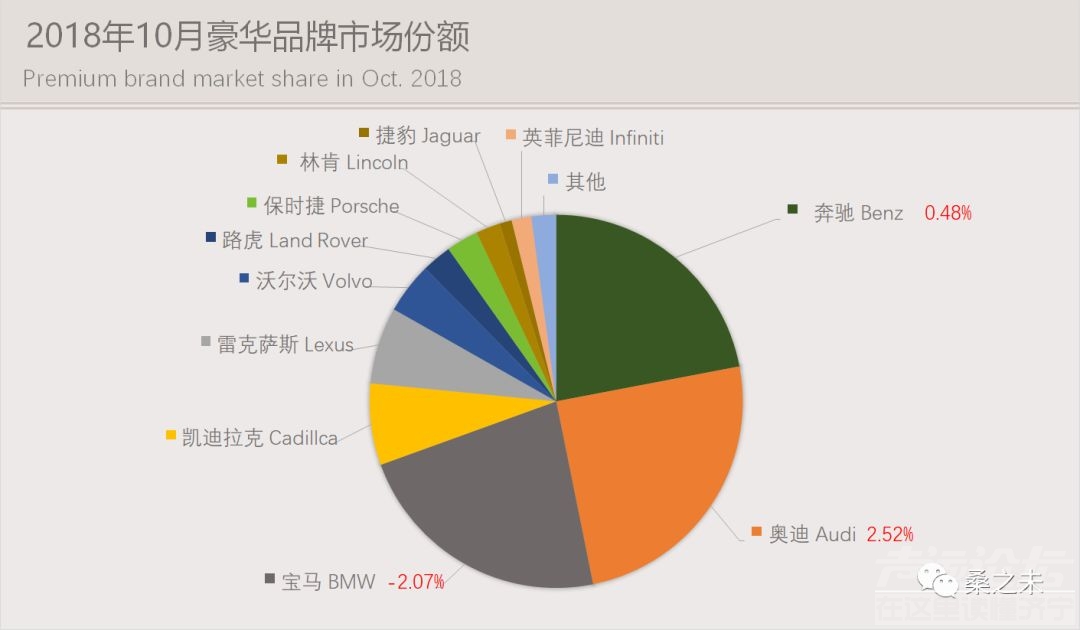

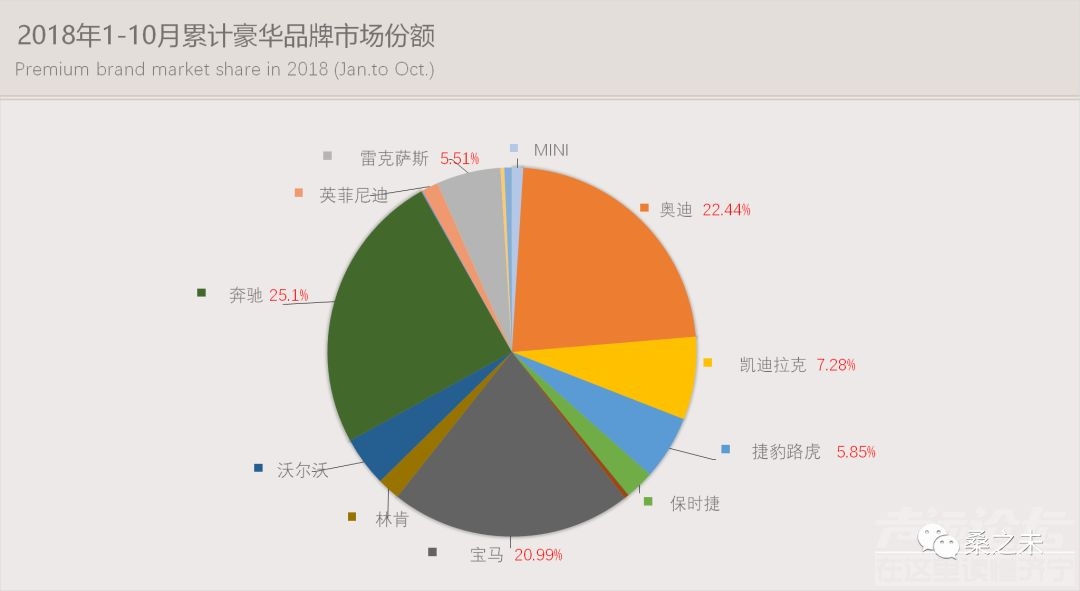

从市占率角度看:10月,以20个豪华品牌经销商零售数据计算,奥迪本月市占率为24.8%,环比下降1.4个点,排名第一;奔驰市占率为22%,与上月持平;宝马市占率为为22.6%,环比增长1.6%。凯迪拉克排名第四,市占率7%,雷克萨斯以6.7%的市占率排名第五。从1-10月累计销量市场占率看,奔驰市占率为24.8%,奥迪市占率为22.7%,宝马市占率为21.1%,凯迪拉克为7.3%,名列前四。

10月豪华零售市场综合看,经销商没有产生太多库存,供需平衡,市场成交均价也趋于稳定。进入第四季度,各品牌车企均比较理性,能够充分考虑整体经济环境对汽车零售市场的冲击,重视销售质量与经销商盈利状况,豪华车市场经过6-9月份的冲量清库存,也急需在第四季度修复利润。

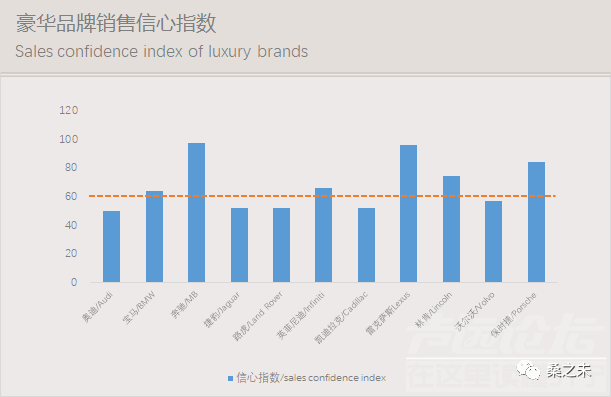

本期报告依据”价格折扣”、”库存深度”以及”虚报(超报)系数”,根据各项指标的权重进行计算了“新车销售信心指数”;其中汽车价格折扣占50%权重,经销商库存深占40%权重,虚报(超报)系数占10%权重,所有数据均来自经销商调研数据。“新车销售信心指数”用来观察经销商对于各家品牌车企销售新车的积极性,分数越高,经销商在销售新车方面动力越强;分数低,表明经销商对销售该品牌新车意愿不强。10月末调研品牌经销商对销售新车信心与上月持平。

■ 奔驰(含smart、V级)

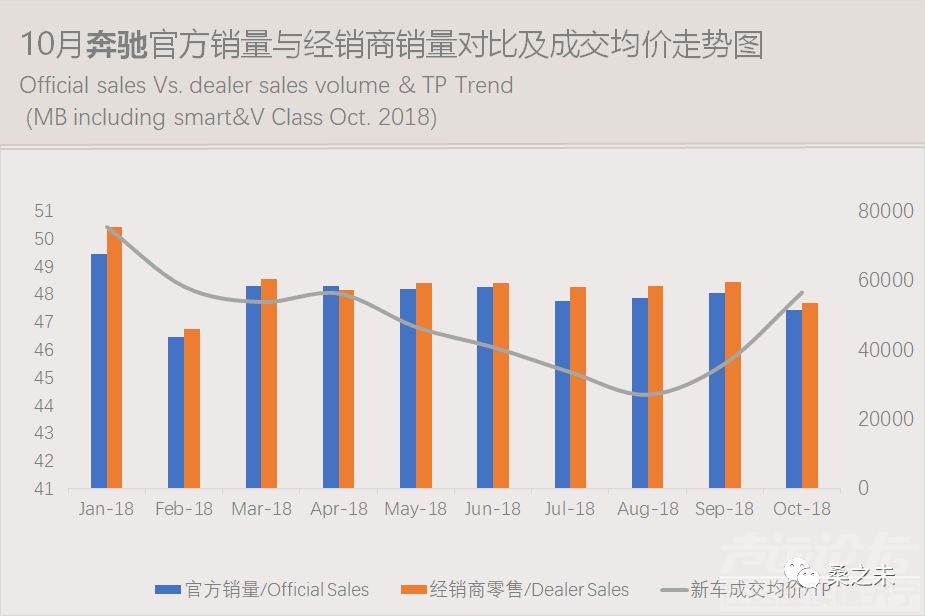

10月份,奔驰官方公布的销量为51,558辆,同比增长8.2%,环比下降8.5%。1-10月累计销量为56.5万辆同比增长11.3%。10月份,奔驰经销商零售量为5.3万辆,同比增长7.6%;1-10月奔驰累计经销商零售量为58.9万辆,同比增长12.2%。以20个豪华品牌经销商零售量来计算市占率,9月奔驰市占率22.0%,1-10月,奔驰累计市占率为24.8%,在豪华品牌中排名第一。

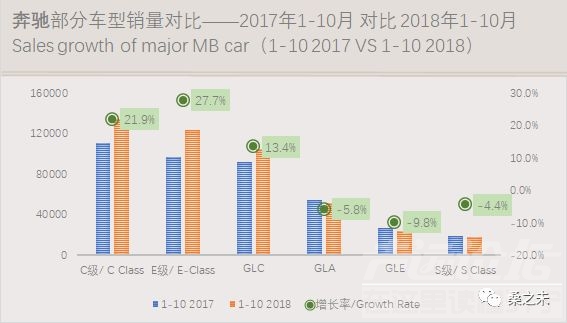

10月,奔驰两款新车中期小改款,奔驰C改款新增混动版本,GLC改款加长;但今年对于上新车型的车企都是一个考验,市场需求在减少,如果上新初期供货量控制不好,新车折扣会迅速加大。这两款主力车型改款,零售折扣环比减少较大,按财务方式计算,带动品牌成交均价回升。

今年1-10月份奔驰进口车零售超过16.5万辆,宝马同期销量为15.7万辆,因为X3国产,导致进口车销量下滑6.7%,自2006年以来宝马进口车销量排名第一,有可能在今年被奔驰超越。

今年对经销AMG车型的奔驰经销商是一个考验,经济低迷直接导致购买高价格的性能车用户减少,AMG车型1-10月份厂家批发已超9500辆,全年预计到达11,000台以上;实际1-10月份经销商零售上牌仅为7300多辆,经销商库存以及未上牌车辆在2200辆左右,库存系数接近1.5左右,美系AMG车型库存在3.0以上,如果按平均单价80万计算,占用资金17.6亿,经销商财务成本支出较大,以财务口径计算的折扣率已经接近盈亏平衡线;过去两年AMG经销商GP3平均为+4%左右,今年个别经销商单月GP3一度降至-10%左右。9月随着新款G63陆续到店,各店盈利情况逐步好转。如果AMG车型不适度控制批发节奏,今年经销商盈利不会有太多改善。

■ 奥迪

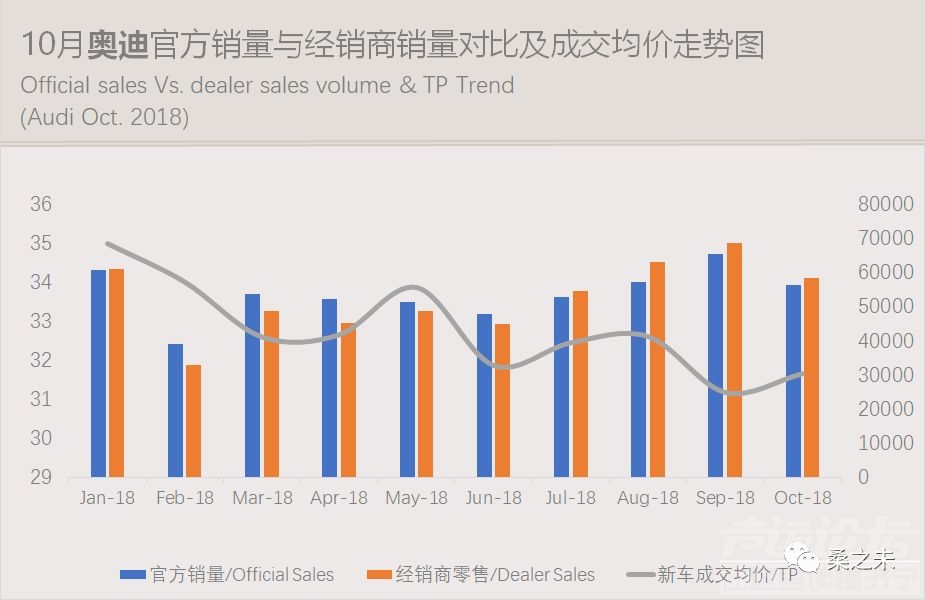

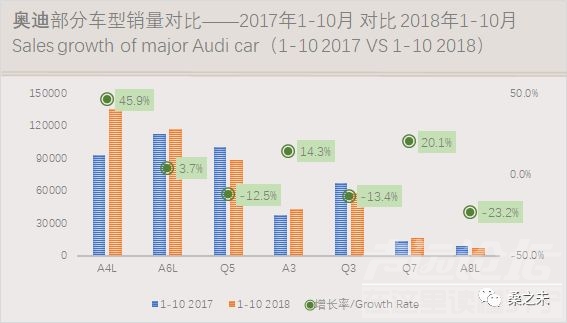

10月,奥迪官方公布的销量为56,499辆,同比增长5.4%,环比下滑14%。1-10月累计销量为53.8万辆同比增长14.4%。10月份,奥迪经销商零售量为5.8万辆,同比增长17.1%,环比下降14.8%,经销商零售比官方公布销量多出近2000台,可视为经销商清掉的库存。10月奥迪市占率为24.8%,1-10月,奥迪累计市占率为22.7%,在豪华品牌中排名第二。

10月,奥迪最为畅销的两款车型奥迪A4L本月销量1.5万辆,奥迪A6L销量达1.5万辆,成交均价与上个月持平,新款Q5L本月销量维持在4000辆上下,增加不到1000台。本月经销商库1.75,库存微增微增0.2,新车成交均价开始回升。

■ 宝马(含mini)

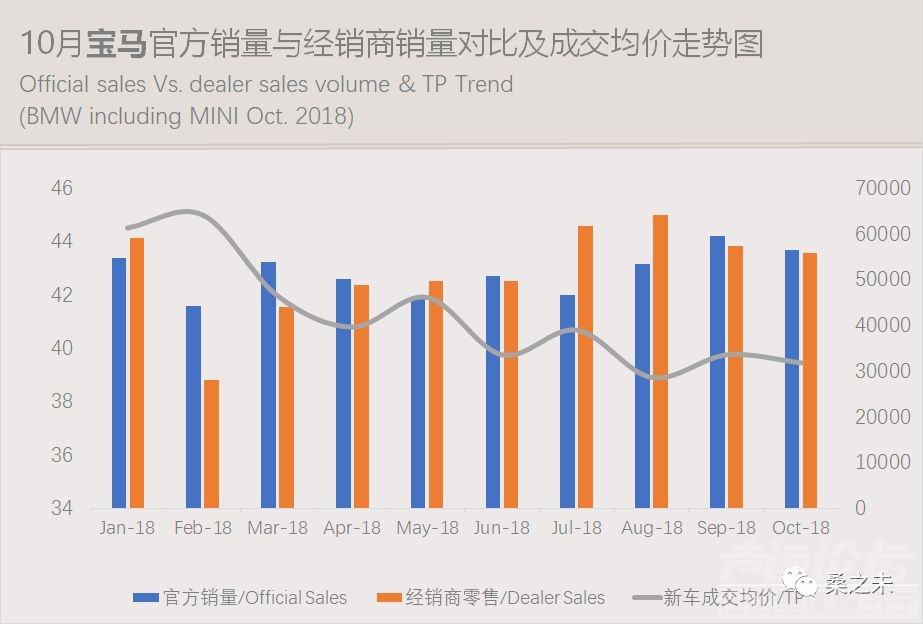

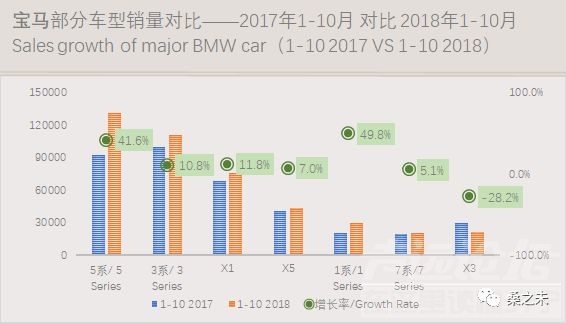

10月,宝马官方公布的销量为56,439辆,同比增长12%,环比下滑5.3%。1-10月累计销量为51.6万辆增长6%。10月份,宝马经销商零售量为5.6万辆,同比增长10%,环比下滑2.4%;官方公布销量比经销商零售多出2000多台,经销商库存开始产生新库存,1-10月宝马累计经销商零售量为51.9万辆,同比增长11.9%。以20个豪华品牌经销商零售量来计算市占率,宝马10月市占率为22.7%,环比增长1.6%,1-10月,宝马累计市占率为21.2%。

10月,宝马新车成交均价微降。新款X3经销商零售销量本月与上月持平,价格比较稳定,X3已经成为宝马提升经销商利润的主要车型。

■凯迪拉克

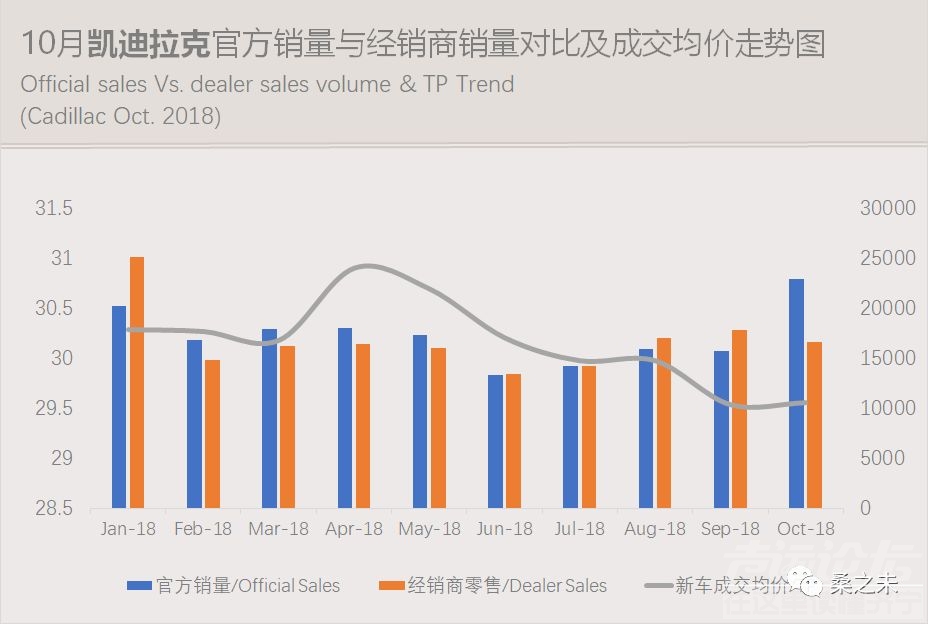

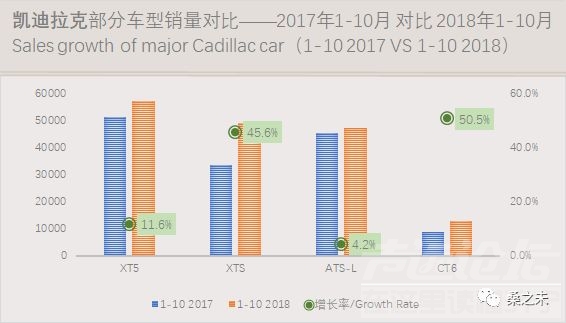

10月,凯迪拉克乘联会统计销量为2.3万辆,同比下滑35%,环比增长46%,1-10月累计销量为18.1万辆增长26.7%。10月份,凯迪拉克经销商零售量为1.7万同比增长10%,环比下滑7%,1-10月累计经销商零售量为16.8万辆,同比增长21%。10月经销商新增库存6000多台,今年累计新增库存近1.3万辆,这在豪华品牌去库存的大前提下,显得与众不同。10月,凯迪拉克市占率为7.0%,环比增长0.3%,1-10月累计市占率为7.3%。

凯迪拉克本月新增6000量库存,使得今年经销商累计库存达到1.3万辆,经销商库存从9月份开始凸显,到了10月份雪上加霜,新车成交均价跌进30万元,进入传统合资品牌价格范围内,如果厂家不适当减少批发,年底之前经销商将会被迫降价清库,回笼资金。

■ 雷克萨斯

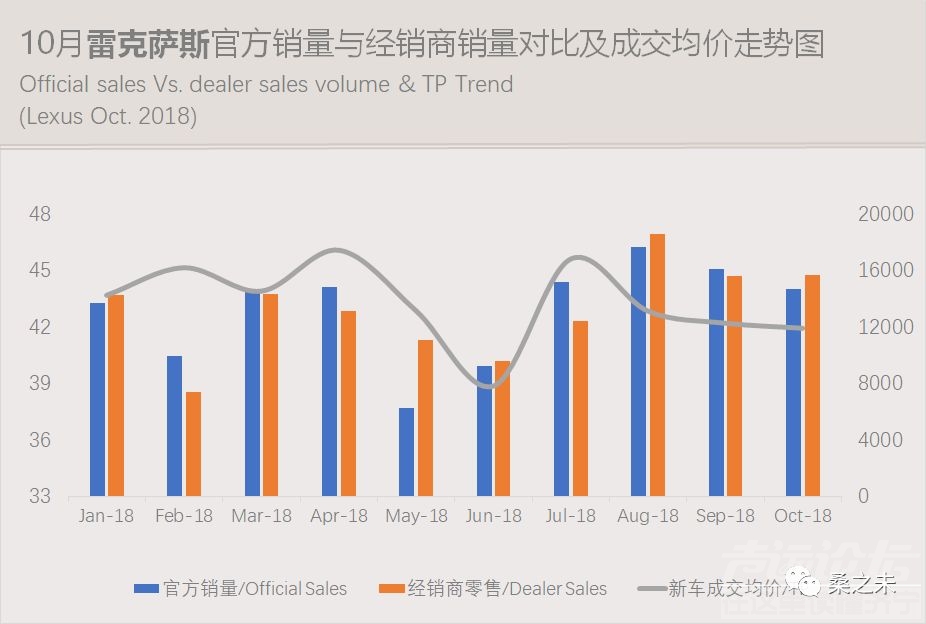

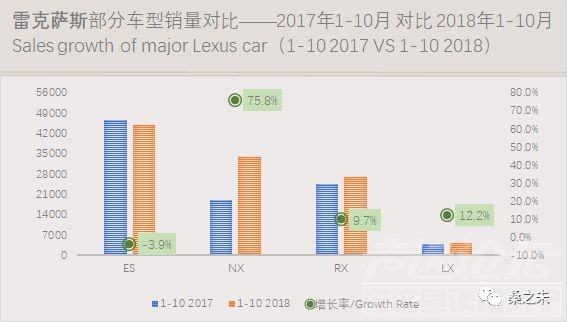

10月份官方销量为14,686辆,同比增长18%,环比下滑8.8%,1-10月累计销量为13.2万辆,增长24%;10月份,雷克萨斯经销商零售量近1.6万辆,同比增长52%,环比增长呢0.2%,1-10月累计经销商零售量为13.2万辆,同比增长27%。10月雷克萨斯市占率为6.7%,1-10月累计市占率是5.6%。

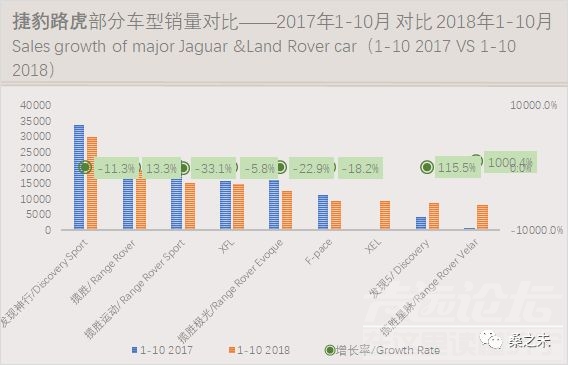

■ 捷豹路虎

10月份,捷豹路虎经销商零售0.86万辆, 1-10月累计经销商零售量为13万辆;9月捷豹路虎的市占率为3.7%,1-10月累计市占率为5.6%。

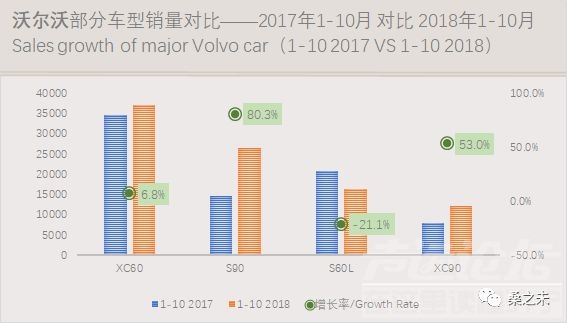

■ 沃尔沃

10月份官方销量为11,083辆,同比增长3.2%,环比下滑16%,1-10月累计销量为10.7万辆同比增长15%;10月份,沃尔沃经销商零售量为1.04万辆,同比增长0.7%,环比下滑16%,1-10月累计经销商销量为10.2万辆,增长14.8%;10月沃尔沃的市占率为4.2%,1-10月累计市占率为4.36%。

10月,沃尔沃经销商增加较快,沃尔沃也是少有还在继续奖励经销商提车的车企,在目前这种商务政策,容易造成虚报,以及使得经销商增加库存。

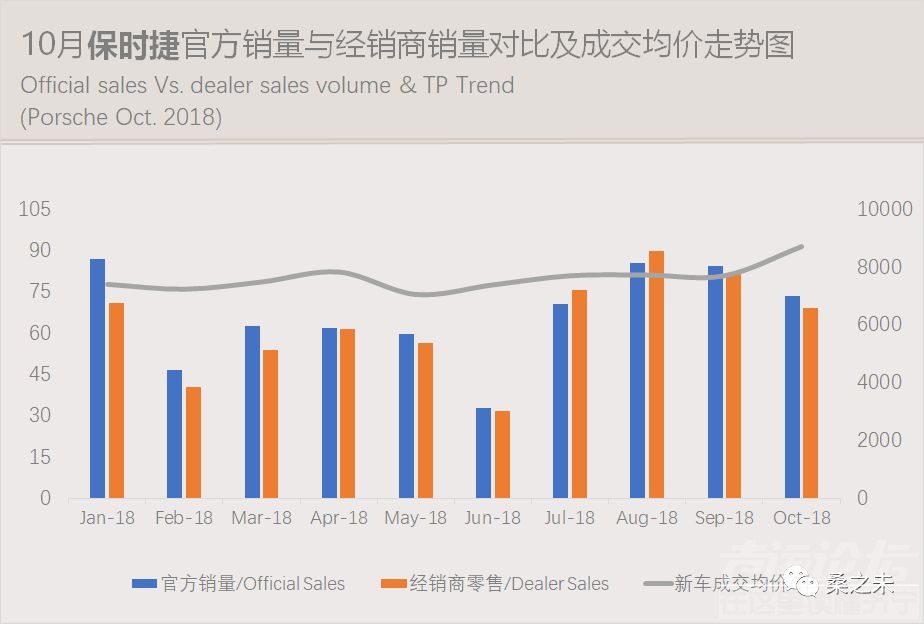

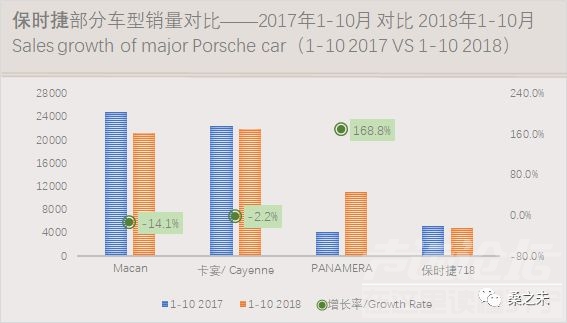

■ 保时捷

10月份销量为7,000辆,同比增长7.2%,环比下滑13%,1-10月累计销量为6.3万辆同比增长4%;10月份经销商零售销量为0.67万辆,同比增长20.1%,1-10月累计经销商销量为6.0万辆,同比增长3.7%;9月保时捷的市占率为2.8%,1-10月累计市占率为2.6%。

今年进口车关税下调,国5车型清库,这两个事件,打乱了保时捷在华的销售节奏,先是暂停了一段时间批售,7月后经销商新车集中到货,资金实力差的店,开始降价或者向二网批售;进入10月份,部分即将实施国6城市的经销商开始清国5车,这部分车源流向有消费能力的城市,扰乱了当地价格。年底之前,部分资金实力差的经销商估计会进一步加快库存的清理。

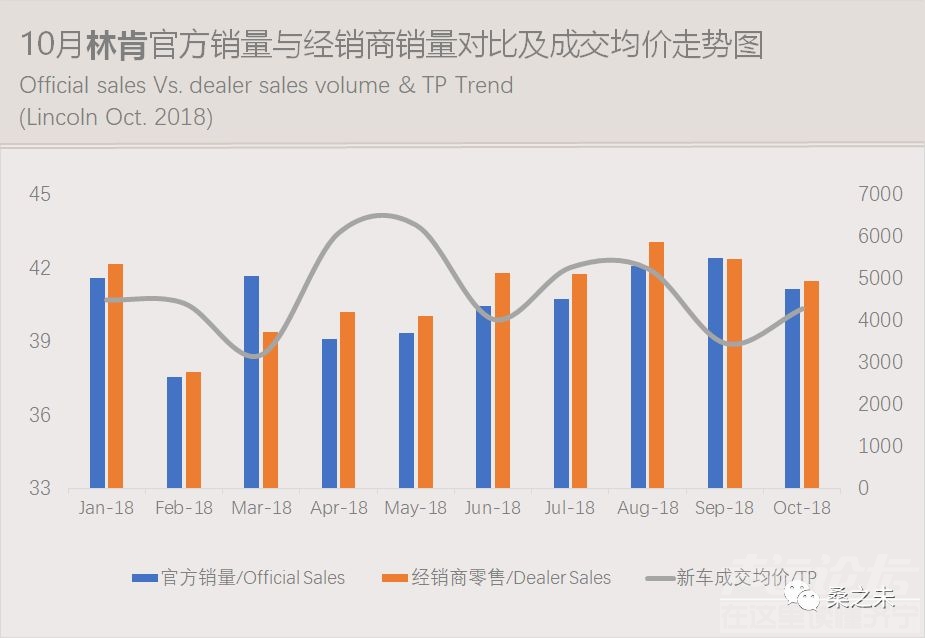

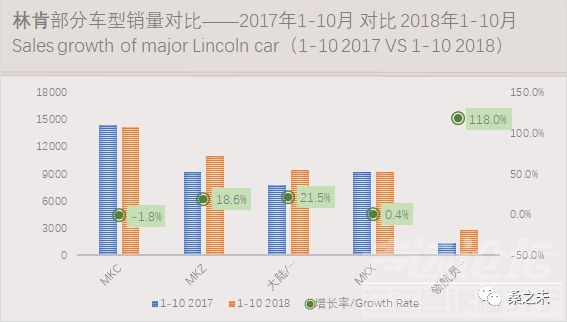

■ 林肯

10月份官方销量为4,753辆,同比下滑6%,环比下滑13%,1-10月累计销量为4.4万辆,同比下滑2.9%;10月份,林肯经销商零售量为0.49万辆,1-10月累计经销商零售量为4.7万辆,增长11%;10月林肯市占率为2.09%,1-10月累计市占率为2%。

■ 英菲尼迪

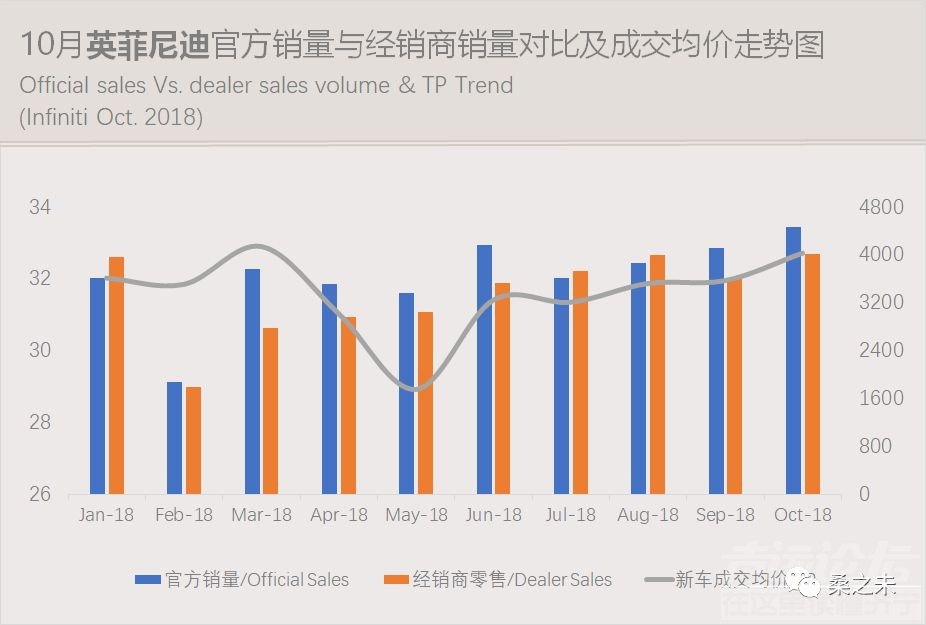

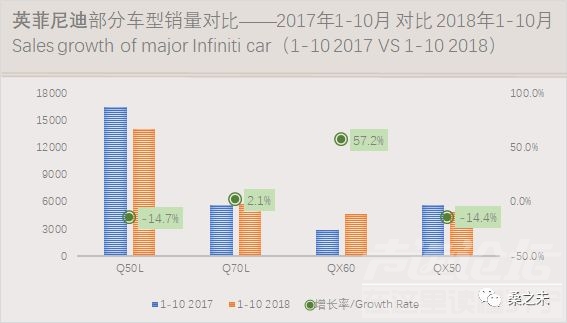

10月份官方销量为4,469辆,同比增长7%,环比增长8.5%,1-10月累计官方销量为3.6万辆,同比下滑4.3%;10月英菲尼迪经销商销量为0.36万辆,同比增长9%,1-10月累计经销商销量为3.3万辆,同比下滑9.6%;10月,英菲尼迪的市占率为1.7%,1-10月累计市占率为1.5%。QX50销量经过缓慢爬升,10月销量达到1800多台,逐渐打开局面。

■ 玛莎拉蒂

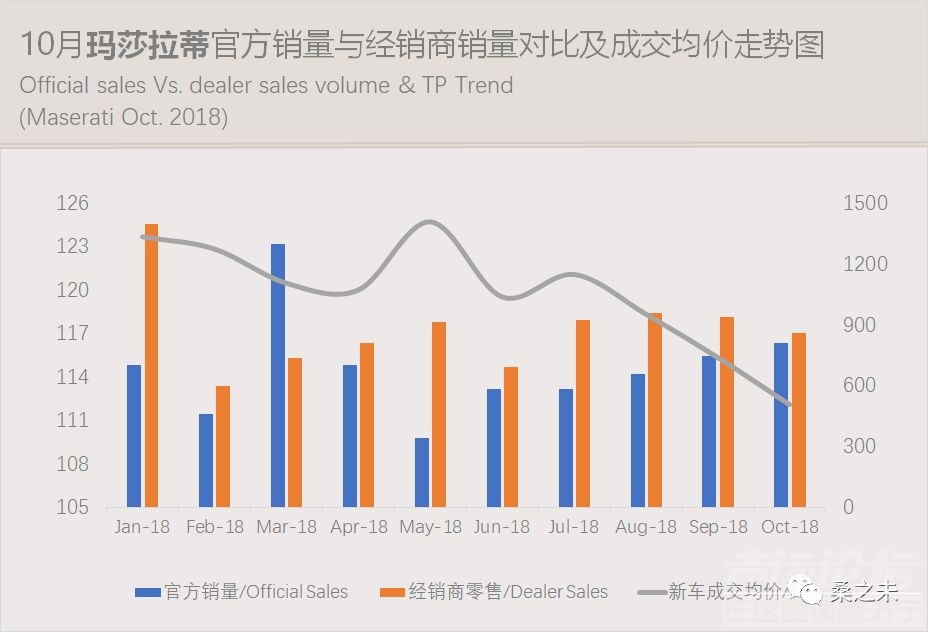

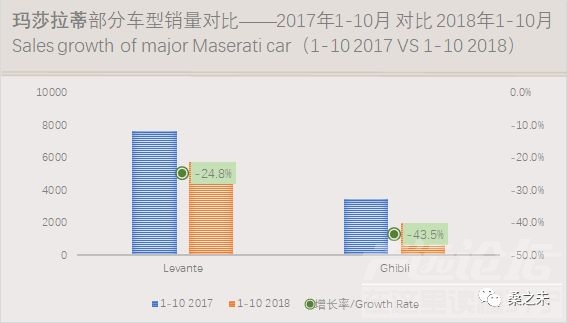

10月份经销商销量为1000辆左右,同比下滑20%,环比下滑8%,1-10月累计经销商销量近0.89万辆,同比下滑33%;10月经销商折扣环比下滑3个多点;玛莎拉蒂的10月市占率为0.36%,1-10月累计市占率为0.38%。

玛莎拉蒂也是今年问题较多的品牌,2017年年底上涨了5%的MSRP标签价格,让经销商集中批售未涨价车辆,造成每家经销商挤压了几百台车库存。2018年汽车关税下调,没有研究市场需求变化,过高预估市场需求,向经销商压批售,特别是对资金充足得集团持续压量,进一步增加了经销商库存;下半年受整体经济环境影响,经销商财务成本增加较快,玛莎拉蒂给予经销商补贴速度补贴慢,到现在还未到账,经销商资金运营困难;经销商为自救清库,但加剧市场价格恶化;价格的持续下探给品牌带来负面影响。

■ 讴歌

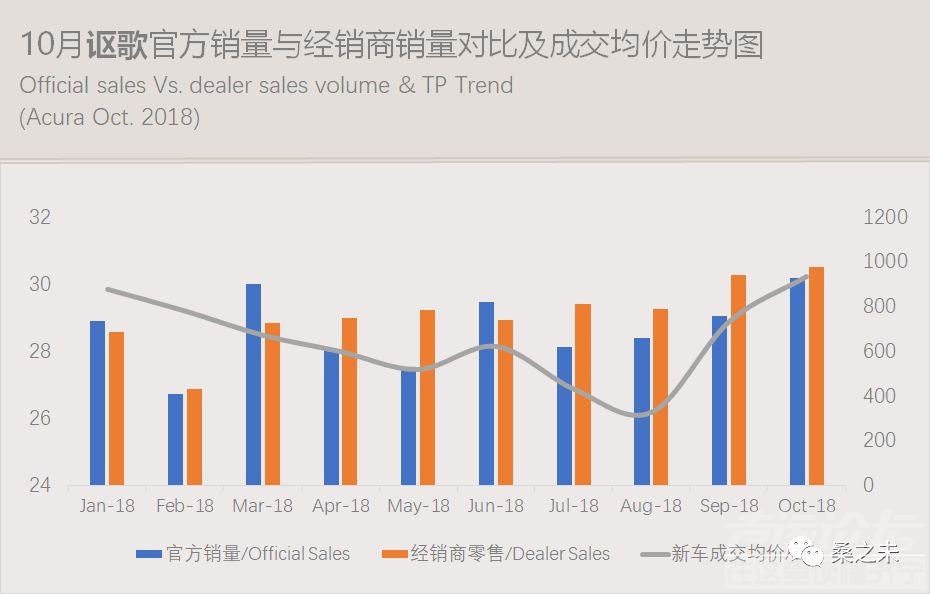

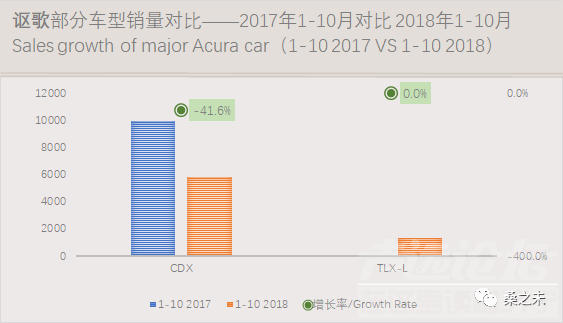

10月份官方销量为927辆,同比下滑43%,环比增长22%,1-10月官方累计销量为6946辆,同比下滑43%;10月,讴歌经销商零售量为978辆,1-10月累计经销商零售量为7633辆,同比下滑29%;10月讴歌市占率为0.4%,1-10月累计市占率为0.33%。近两年,讴歌这个品牌运营已经没有状态,新上市的车型只有几百台销量,经销商渠道拓展困难,如果没有补贴,经销商都无法支撑下去。

■ 特斯拉:

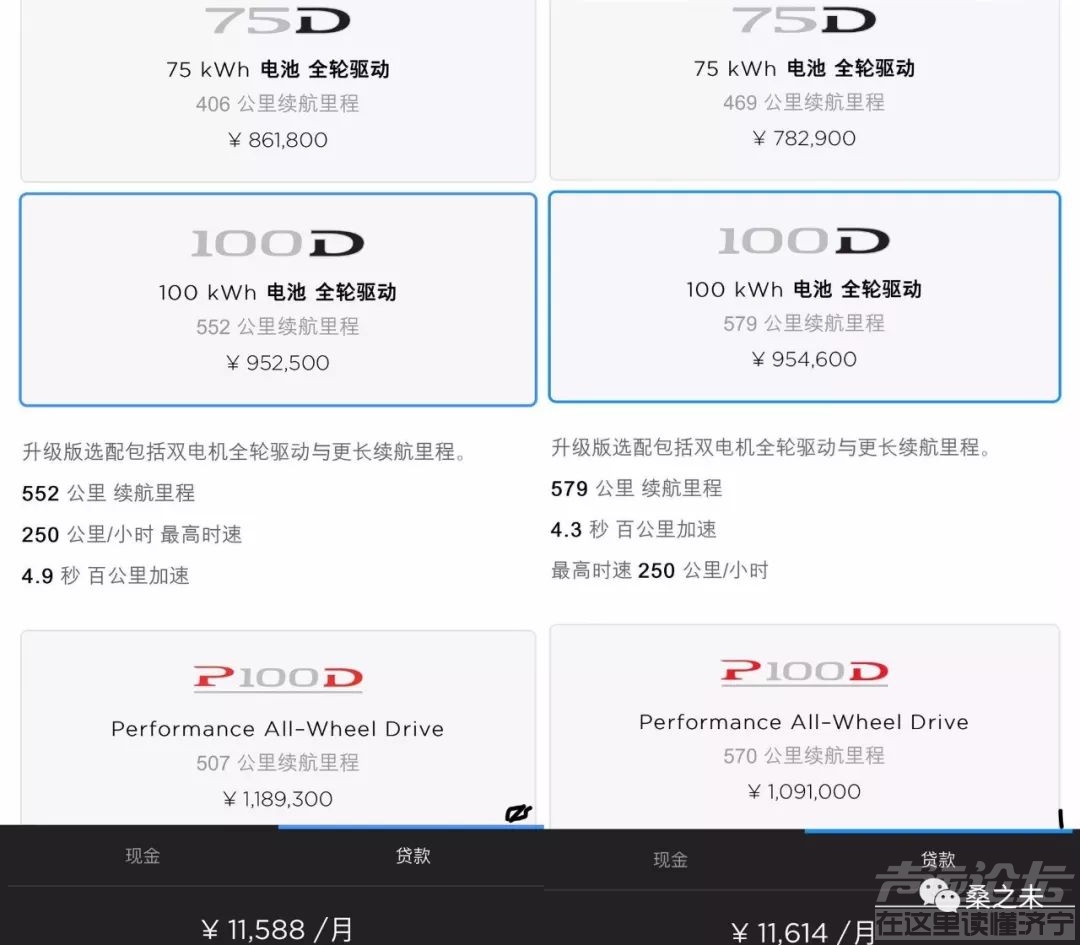

10月,特斯拉在华零售近148台,同比下滑318%。1-10月在华零售近1.4万辆,同比增长0.7%。从11月22日起,特斯拉在中国销售的Model S,Model X电动车的价格下调12%-26%,基本回到了15%关税水平。Model 3接受预定,长续航电池双电机全轮驱动版起售价54万元,Model 3 Performance 高性能全轮驱动版为59.5万元。

此前10月特斯拉收到关税上调的影响凸显,进口量已经归零,市场零售仅为148台,40%关税水平使得汽车生意没法作了。特斯拉销售也存在季度冲量的特点,一般季度初销量低,季度末销量高,四季度销量最终如何还需要看12月份的交付量。

国产豪华品牌— 红旗,10月,经销商销量为3350辆,1-9月红旗经销商零售量为1.85万辆。

国产高端品牌— 长城 Wey,10月官方销量为10,884辆,1-10月累计销量为116,381辆。10月经销商销量为8289辆,同比下滑29%,环比增长36%,1-10月,经销商累计销量为10万辆。Wey经销商累计库存为1.63万辆。

Wey品牌去年同期有三个车型在售,截止到今年10月Wey有5个车型在销售,前期推出的VV7s、VV5s销量下滑至2000台多左右,新上市的VV6在10月销量突破3000台,成为销量最多的车型,Wey产品多为同质化产品,新产品并没有拓展新客户群,只是分化了现有用户群。

以过去三个月wey 4S店均月销售量来看,wey经销商库存系数为2.25。以Wey官网统计,Wey有278个销售网点(包括4S店、二级网点、展示中心),平均单店月度销售量在26台左右。从市场零售价格看VV7s、VV5s折扣率在8%上下。Wey的渠道数量虽然在过去的一年中得到快速增长,但是渠道质量太差,单店销售能力低,这些都束缚了Wey产品的以进一步增长。

国产高端品牌— 吉利领克,10月官方销量为15,207辆,1-10月累计销量为102, 308辆。10月,领克经销商销量为0.85万辆,环比下滑20%,1-10月累计销量为7.62万辆,经销商累计库存2,6万辆,比上月新增7000辆库存,自2017年11月上市以来,领克经销商累计库存达3万辆,以过去三个月领克4S店月均销售量来看,领克经销商库存系数在3.0左右;以领克官网统计,领克有202个销售网点(包括4S店、二级网点、展示中心),平均单店月度销售量在49台左右。

领克目前存在的问题是经销商库存较高,并且连续两个月新增库存增长都在7000台左右,高库存对经销商融资能力提出很高的要求;领克零售折扣各地不同,一二线城市折扣在4个点左右,部分地区零售没有折扣,厂家为领克经销商提供6个月库存融资,经销商资金压力不大;目前领克经销商渠道数量较少,需要快速拓展渠道数量,以增加销量,消化库存。

国产高端电动车—蔚来:10月,蔚来官方公布销量为1573辆,累计销量为4941辆,10月蔚来ES8上牌量为1602辆,累计上牌5016辆。

版权声明:本文系@桑之未 #原创首发# 转载或改编请与本人沟通,如有任何侵权行为,侵权者将承担相应的法律责任。汽车行业人士留言可以索取本人微信号码,更多行业信息查阅朋友圈分享内容。2018-11-25

---往期精选 | More Reading ---

? 豪华车零售累计突破200万辆,车价下探侵蚀中高级合资品牌市场份额

? 前八月经销商新车利润下滑50%,豪华车市场以价换量趋势明显

? 8月豪华车零售市场保持两位数增长,部分品牌新车成交均价回升

? 7月豪华车零售市场增长14.6% 宝马奥迪经销商清库存奔驰经销商作利润

?你们关心的蔚来ES8零售数量都在这里 上海北京用户提车最多

The Passenger Car Market Faces Downturn, the Sales Volume of Luxury Cars Increases against the General Trend, and the Retail Volume Accounts for 50% of the Sales Volume of Luxury Cars in 20 Cities

Written by / Sang Zhiwei

Insight into the Chinese Luxury Car Market

Report | Data | Consulting

Keywords:Luxury car market, Sales volume of dealer, Market share,Average selling price,Discountrate

The luxury car market has become the most promising segment in the passenger car market

In October, the accumulative sales volume of dealers in the domestic passenger car market had negative growth for the first time, and the accumulative retail volume of social consumer goods of cars also had negative growth for the first time; as of October, the accumulative retail volume of luxury car dealers still maintained a growth of 11.5% compared with that in the same period of last year, belonging to the fast-growing segment in the passenger car market; this was because domestic luxury cars had the pricing advantage, and they gradually entered the price range of middle and high class joint venture brands by increasing discounts, squeezing the survival space of medium and high class models in the joint venture companies; and in addition, the new models launched in the past two years entered the sales growth period, which led to the total growth of sales volume of luxury cars.

In the next few years, the luxury car retail market will continue to grow steadily. In the first ten months of this year, the market share of luxury car dealers in the retail market was 12.7%, while that of the mature luxury cars would be generally close to 25%. The future growth space is relatively large. Among cities whose market share of retail of luxury cars was over 25% from January to October in China, only that Shanghai reached 29.9%; the market share of luxury cars in Beijing, Shenzhen and Nanjing was about 23%; the market share of luxury cars in Hangzhou, Dalian, Xiamen and Suzhou was about 20%; the market share of luxury cars in 20 cities was over 12.7%, keeping pace with the overall market share of luxury cars this year; and the accumulative sales volume of these 20 cities was 1.17 million in the first ten months, accounting for 50% of the sales volume of luxury car market. If the sales of luxury brand OEMs in these 20 cities keep up with the pace, the overall sales performance this year will not be too poor.

The state does not save the market, but it should sort out and remove policies which impede vehicle consumption and circulation.

This year, the sales of bulk durable consumer goods are sluggish, and automobiles are the most typical. Whenever the sales of automobiles are sluggish, the automotive industry will have the voice of national rescue. Recently, the Development and Reform Commission stated that the state would not rescue the market. The main reason for the market downturn is that the implementation of the preferential tax policy on the purchase of passenger cars with small displacement in the early stage has led to the release of some consumer demand ahead of time, and the changes in the international and domestic economic situation affect market expectations to a certain extent, all of which have a certain impact on the recent automobile production and sales". In addition, "the base of the same period of last year is relatively high, and the scale of automobile production and sales in China ranks the first in the world, so it is difficult to sustain rapid growth." In fact, it denied that the state would "rescue the market".

If we simply "cut the purchasing tax in half" as a way of rescuing the market, it will not have much effect. The implementation of this policy in the past two years has already overdrawn consumption in advance. We should start from organizing the policies that hinder the consumption and circulation of automobiles, such as the restriction on the relocation of used cars, the temporary property rights of used cars, the reform of tax and fee for used car transactions, the cancellation of license and number limitation in some cities, the introduction of automobile consumption credit with low interest rates and low handling fees, etc.

The total retail volume of social consumer goods of automobiles had a negative growth for the first time

According to the data of the National Bureau of Statistics, the total retail volume of social consumer goods of automobiles was RMB325.4 billion in October, down by 6.4% YoY. It declined for six consecutive months. The accumulative retail volume of automobiles was RMB3,100 billion from January to October, down by 0.6% YoY. The total retail volume of automobiles in the whole year had a negative growth for the first time, which was relatively rare in recent years. Among them, the total retail volume of luxury cars in October was nearly RMB96.4 billion, accounting for 29.6% of the total retail volume of automobiles, down by 1.2% MoM. The accumulative retail volume of luxury cars was nearly RMB1,000 billion, from January to October, accounting for 31% of the total retail volume of automobiles.

In October, the retail volume of luxury cars increased by 11.3%, and volume and price both entered a stable period.

Retail of dealers:In October, the retail volume of passenger car dealers nationwide was 1,920,000, down by 12% YoY. It declined for five consecutive months. From January to October, the accumulative sales volume was 18.38 million, down by 1.2% YoY, which was also the first time that the accumulative sales volume of dealers had a negative growth this year.

In October, the retail volume of luxury brand dealers was nearly 2,40,000, up by 11.3% YoY. The market share was 12.3%. From January to October, the accumulative retail volume of luxury car dealers was 2,330,000, up by 11.5% YoY. The market share was 12.7%, up by 1.5% YoY.

Official sales volume of luxury brand OEMs: In October, the official sales volume of 12 luxury brand OEMs was 238,000, up by 6.5% YoY and down 6.4% YoY and down by 6.4% MoM. The accumulative sales volume from January to October was 2,308,000, up by 10.2% YoY.

From the perspective of price:the overall market discount rate of luxury cars decreased by 0.2% in October MoM. The golden September and silver October did not happen, and OEMs did not give much stock for dealers, so the retail market prices in October were relatively stable. From the perspective of brand, the retail discounts of Jaguar Land Rover rebounded. The overall discount rate of Lincoln, Volvo, Maserati and other brands increased.

From the perspective of customer flow and inventory:Through the survey of dealers, the customer flow in October declined YoY. Customer flow of Audi, Mercedes-Benz, Jaguar Land Rover, Volvo and other brands dropped by more than 2% MoM, while customer flow of BMW, Lexus, Lincoln, Infiniti and other brands remained slightly increase. Last October, the policy of "cutting purchasing tax by half" popular on the market was about to be abolished, which had a great impact on the consumers. In addition, golden September and silver October were the traditional sales peak season, which led to the growth of the overall customer flow. This year there is no such a good factor. The influence of partial overdraft consumption already appeared.

In October, the inventory of dealers was the same as that of last month, which was relatively reasonable. The brands with an inventory exceeding 1.6 were Audi, Jaguar Land Rover, Cadillac, Lincoln, Volvo, etc. Among them, the inventory of Lincoln and Volvo ranked the first and exceeded 1.8. In October, the inventory of Audi and BMW rose slightly. Mercedes-Benz's new C and GLC L were launched in October, and began to distribute one after another. The dealer inventory fell slightly.

From the perspective of market share: in October based on the retail volume data of dealers of 20 luxury brands, the market share of Audi was 24.8% this month, down by 1.4% and ranking the first; that of Mercedes-Benz was 22%, which was the same as that of last month; and that of BMW was 22.6%, up by 1.6% MoM. The market share of Cadillac was 7%, ranking the fourth. The market share of Lexus was 6.7%, ranking the fifth. Seen from the market share of accumulative sales volume from January to October, the market share of Mercedes-Benz was 24.8%, Audi 22.7%, BMW 21.1%, and Cadillac 7.3%, ranking the top four.

In October, seen from the overall luxury retail market, the dealers did not increase much inventory, supply and demand were balanced, and the average market transaction price also tended to be stable. In Q4, OEMs were relatively rational. They could fully consider the impact of the overall economic environment on the automobile retail market, and pay attention to sales quality and dealer profitability. After the increase of sales volume and inventory clearing from June to September, the luxury car market is also in urgent need of recovering profits in Q4.

Based on "price discount", "inventory depth" and "false reporting (overreporting) coefficient", in this report the "confidence index of sales of new cars" was calculated according to the weight of each index. Among them, automobile price discount accounts for 50% of the weight, the depth of dealer inventory accounts for 40% of the weight, and the false reporting (overreporting) coefficient accounts for 10% of the weight. All data are from research data of dealers. "The confidence index of sales of new cars" is used to observe the enthusiasm of dealers to sell new cars for OEMs. The higher the score is, the stronger the power of dealers in selling new cars is; and the lower score indicates that dealers are not willing to sell new cars of this brand. At the end of October, according to the research, brand dealers' confidence in selling new cars was the same to that of last month.

■ Mercedes-Benz (including smart, V-class)

In October, the official sales volume of Mercedes-Benz was 51,558, up by 8.2% YoY and down by 8.5% MoM. The accumulative sales volume from January to October was 565,000, up by 11.3% YoY. In October, the retail volume of dealers of Mercedes-Benz was 53,000, up by 7.6% YoY; and from January to October, the accumulative retail volume of dealers of Mercedes-Benz was 589,000, up by 12.2% YoY. Calculating the market share with the retail volume of dealers of 20 luxury brands, the market share of Mercedes-Benz was 22.0% in September. From January to October, the accumulative market share of Mercedes-Benz was 24.8%, ranking the first among luxury brands.

In October, the facelift of two new Mercedes-Benz models was completed, the new light hybrid version of Mercedes-Benz C was newly added, and the modified model of GLC was lengthened, but there was a test for OEMs who launch new models this year. The market demand is decreasing. If the initial supply volume is not controlled properly, the discount of new cars will increase rapidly.

From January to October this year, the retail volume of Mercedes-Benz imported cars was more than 165,000, the sale volume of BMW was 157,000 in the same period. Because X3 was domestic produced, the sale volume of imported cars decreased by 6.7%. Since 2006, the sales volume of BMW imported cars ranked the first, which was likely to be surpassed by that of Mercedes-Benz this year.

This year there is a test for dealers of Mercedes-Benz who has AMG authorization. The economic downturn has directly reduced the number of users who buy high-priced performance cars. The wholesale volume of AMG models of manufacturer from January to September has exceeded 9,500, and is expected to be above 11,000 in the whole year. Actually, from January to October the retail volume of dealers was more than 7,300, the inventory of dealers was about 2,200, and the inventory coefficient was close to 3.0. Calculating with the average unit price of RMB800,000 and the capital occupied of RMB1,760 million, the dealers' financial cost is relatively big. The discount rate calculated in terms of finance has broken the breakeven line. In the past two years, the average GP3 of AMG dealers was about +4%. This year, the GP3 of individual dealers dropped to about -10% in a single month. With the new G63 model arriving in stores in September, the profitability of the stores gradually improved. If the pace of wholesale is not properly controlled for AMG model, dealers’ profits will not improve a lot this year.

■ Audi

In October, the official sales volume was 56,499. Up by 5.4% YoY and down by 14 % MoM. From January to October, the accumulative official sales volume was 538,000, up by 14.4% YoY. In October, the retail volume of dealers of Audi was 58,000, up by 17.1% YoY and down by 14.8 %.The retail volume of dealers was nearly 2,000 more than the official sales volume, which could be regarded as the inventory cleared by dealers. In October, the market share of Audi was 24.8%, and from January to October the accumulative market share was 22.7%. Ranked second in luxury brands.

In October, the sales volume of Audi A4L and Audi A6L, two best-selling models of Audi, both was 15,000. The average transaction price was the same as that of last month. The sales volume of the new Q5L remained around 4,000 this month, increasing by less than 1,000. The discount increased. The inventory of dealers of this month was 1.75, increasing slightly by 0.2 in a reasonable range.

■ BMW (including mini)

In October, the official sales volume was 56,439, up by 12% YoY and down by 5.3% MoM. From January to October, the accumulative sales volume of dealers was 516,000, up by 6% YoY. In October, the retail volume of dealers of BMW was 56,000, up by 10% YoY and down by 2.4 %.The official sales volume was 2,000 more than the retail volume of dealers. Dealers began to load new inventories. The accumulative retail volume of dealers of BMW from January to October was 519,000, up by 11.9% YoY. Calculating the market share with the retail volume of dealers of 20 luxury brands, the market share of BMW in October was 22.7%, up by 1.6% MoM, and the accumulative market share of BMW from January to October was 21.2%.

In October, the average transaction price of new cars of BMW dropped slightly. The retail volume of dealers of new X3 was the same as last month. The price was relatively stable. X3 has become the main model for BMW to increase dealers’ profits.

■ Cadillac

In October, the Cadillac federation statistics sales volume was 23,000, down by 35 % YoY and up by 46 % MoM. From January to October, the accumulative official sales volume was 181,000, up by 26.7% YoY. In October, the retail volume of dealers of Volvo was 17,000, up by 10% YoY and down by 7%, From January to October, the accumulative retail volume of dealers was 168,000, up by 21% YoY. In October, the new inventory of dealers was more than 6,000. This year, the accumulative new inventory was nearly 13,000, which was quite different under the premise that luxury brands cleared inventory, the market share of Cadillac was 7.0%, up by 0.3% YoY and from January to October the accumulative market share was 7.3%.

The new inventory of Cadillac was 6,000 this month, so that the accumulative inventory of dealers reached 13,000 this year. The inventory of dealers began to highlight in September and worsened in October. The average transaction price of new cars dropped to RMB 300,000 and below, and entered the price range of traditional joint venture brands. If OEM does not reduce wholesale appropriately, dealers will be forced to reduce prices, clear up the treasury and withdraw funds before the end of the year.

■ Lexus

In October, the official sales volume was 14,686, up by 18% YoY and down by 8.8% MoM. From January to October, the accumulative sales volume was 132,000, up by 24% YoY. In October, the retail volume of dealers of Lexus was 16,000, up by 52% YoY and down by 0.2 % MoM, while from January to October the accumulative retail volume of dealers was 132,000, up by 27% YoY. In October, the market share of Lexus was 6.7%, and from January to October the accumulative market share was 5.6 %.

■ Jaguar Land Rover

In October, the official sales volume was 8,600.From January to October, the accumulative official sales volume was 130,000, In September, the market share of Jaguar Land Rover was 3.7%, and from January to October the accumulative market share was 5.6%.

■Volvo

In October, the official sales volume was 11,083, up by 3.2% YoY and down by 16 % MoM. From January to October, the accumulative official sales volume was 107,000, up by 15% YoY. In October, the retail volume of dealers of Volvo was 10,400, up by 0.7% YoY and down by 16 %, while from January to October the accumulative retail volume of dealers was 102,000, up by 14.8 YoY. In October, the market share of Volvo was 4.2%, and from January to October the accumulative market share was 4.36%.

In October, dealers of Volvo increased inventory rapidly. Volvo is also one of minority OEMs that continue to reward dealers for purchasing cars. The current business policy is easy to cause false reporting and increase the inventory of dealers.

■ Porsche

In October, the sales volume of dealers was about 7,000, up by 7.2 % YoY and down by 13% MoM. From January to October, the accumulative sales volume of dealers was 63,000, up by 4% YoY. In October, the retail volume of dealers of Porsche was 6,700, up by 20.1 % YoY, while from January to October the accumulative retail volume of dealers was 60,000, up by 3.7 % YoY, In September, the market share of Porsche was 2.8%, and from January to October the accumulative market share was 2.6%.

This year's tariff reduction on imported cars and the inventory clearing of level V emission standard models disrupted Porsche's sales pace in China. First, it suspended the wholesale for a period of time. After July, the dealers’ new cars arrived together, and the stores with poor capital strength began to reduce prices or sell them to the second network by wholesales. In October, dealers in some cities about to implement level VI emission standard began to clear the inventory of level V cars. These cars flowed to the cities with buying power and disturbed the local prices. Before the end of the year, some dealers with poor financial strength are expected to further speed up inventory clearing.

■ Lincoln

In October, the official sales volume was 4,753, down 6% YoY and down by 13% MoM. From January to October, the accumulative official sales volume was 44,000, down by 2.9% YoY. In October, the retail volume of dealers of Lincoln was 0.49 million, while from January to October the accumulative retail volume of dealers was 47,000, up by 11% YoY; In October, the market share of Lincoln was 2.09%, and from January to October the accumulative market share was 2%.

■ Infiniti

The official sales volume in October was 4,469, up by 7% YoY and up by 8.5% MoM. The accumulative official sales volume from January to October was 36,000, down by 4.3% YoY. In October, the sales volume of dealers of Infiniti was 3,600, up by 9% YoY. From January to October, the accumulative sales volume of dealers of Infiniti was 33,000, down by 9.6% YoY. In October, the market share of Infiniti was 1.7%. From January to October, the accumulative market share was 1.5%. The sales volume of QX50 increased slowly, and was more than 1,800 in October.

■ Maserati

In October, the sales volume of dealers was about 1,000, down by 20% YoY and down by 8% MoM. From January to October, the accumulative sales volume of dealers was 8,900, down by 33% YoY. In October, the discount rate of dealers dropped by more than 3%. In October, the market share of Maserati was 0.36%, and from January to October the accumulative market share was 0.38%.

Maserati is also a brand with many problems this year. At the end of 2017, MSRP increased by 5%, so that dealers sold cars whose prices did not increased by wholesales, and each dealer had the inventory of hundreds of cars. In 2018, the automobile tariff reduced, Maserati did not response to the change of market demand, the market demand was overestimated, and dealers were forced to accept wholesales. Especially cars were sold to the groups with sufficient funds continuously by wholesales, which further increased the inventory of dealers. In the second half of the year, due to the overall economic environment, the financial cost of dealers increased rapidly, and Maserati gave dealers subsidies slowly, which had not yet reached the accounts. Dealers had difficulty in operating funds. To save themselves and clear the inventory, dealers aggravated the deterioration of market prices; and the continuous decreasing of prices had a negative impact on the brand.

■ Acura

In October, the official sales volume was 927, down by 43% YoY and up by 22% MoM. From January to October, the accumulative official sales volume was 6,946, down by 43% YoY. In October, the retail volume of dealers of Acura was 978, while from January to October the accumulative retail volume of dealers was 7,633, down by 29% YoY. In October, the market share of Acura was 0.4%, and from January to October the accumulative market share was 0.33%. In the past two years, Acura brand did not operate well. The sales volume of new models was only a few hundreds. It was difficult for dealers to expand their channels. Without subsidies, dealers cannot continue.

■Tesla

In October, the retail volume of Tesla was nearly 148 in China, down by 318% YoY. From January to October, the retail volume in China was nearly 14,000, up by 0.7% YoY. In October, Tesla was affected by the tariff increase. Imported zero cars and the retail volume was only 148. Tesla’s sales are also characterized by quarterly increase of sales volume. Generally, sales volume is small at the beginning of the quarter and big at the end of the quarter. The sales volume in Q4 still depends on the delivery in December.

Domestic Luxury Brand - Hongqi. In October, the sales volume of dealers was 3, 350, and the retail sales volume of dealers of Hongqi from January to September was 18,500.

Domestic Luxury Brand- Great Wall Wey,In October, the official sales volume was 10,884, and the accumulative sales volume from January to October was 116,381. In October, the sales volume of dealers was 8,289, down by 29% YoY and up by 36% MoM. From January to October, the accumulative sales volume of dealers was 100,000. The accumulative inventory of Wey was 16,300.

Wey had three models on sale in the same period last year. As of October this year, Wey has five models on sale. The sales volume of VV7s and VV5s launched in the early stage decreased to 2,000. The sales volume of newly launched VV6 exceeded 3,000 in October and became the model with the biggest sales volume. Most of Wey products are homogeneous products. New products have not expanded new customer base and just split the existing user groups.

In the past three months, seen from the average monthly sales volume of Wey dealers, the inventory coefficient of Wey dealers was 2.25. According to the statistics on Wey's official website, Wey has 278 sales outlets (including 4S stores, secondary outlets and showrooms). The monthly sales volume of a single outlet was about 26. Seen from the market retail price, the discount rate of VV7s and VV5s was around 8%. Although the number of channels of Wey increased rapidly in the past year, the quality of channels was too poor, and the sales ability of a single store was low, which constrained the sales of Wey products.

Domestic Luxury brand Geely Lynk&Co. The official sales volume in October was 15,207, and the accumulative sales volume from January to October was 102,308. In October, the sales volume of dealers of Lynk&Co was 8,500, down by 20% MoM. From January to October, the accumulative sales volume was 76,200, and the accumulative inventory of dealers was 26,000, which was 7,000 more than that of last month. Since its launching in November 2017, the accumulative inventory of dealers of Lynk&Co reached 30,000. Seen from the average monthly sales volume of Lynk&Co dealers in the past three months, the inventory coefficient of dealers was around 3.0. According to the statistics of Lynk&Co's official website, Lynk has 202 sales outlets (including 4S stores, secondary outlets and showrooms), and the monthly sales volume of a single outlet is about 49.

At present, the problem of Lynk&Co is that the dealers' inventory is relatively high, and the increase of new inventory in two consecutive months was about 7,000. The high inventory had a high demand for dealers' financing ability. The dealers' financial cost increased rapidly, which reduced the dealers' sales profits of new cars. At present, the number of dealer channels of Lynk&Co is relatively small. Lynk&Co needs to increase the number of channels rapidly, so as to increase sales volume and clear inventory.

Domestic luxury electric vehicle-NIO:In October, the official sales volume of NIO was 1,573, and the accumulative sales volume was 4,941. In October, 1,062 NIO ES8 applied number plates and the accumulative number was 5,016.

Copyright statement: This article is anoriginal article published by Sang Zhiwei for the first time. For reproduction or adapting, please communicate with the author. In case of any infringement, the infringer will bear the corresponding legal responsibilities. Readers in the auto industry can leave a message and ask for the author's personal WeChat number. For more information of the industry, refer to the content shared in Circle of Friends. Nov. 25th, 2018, Beijing.

? ? ? MORE READING ? ? ?

? The Sales Volume of Luxury Cars Exceeds 2 Million, and the Price Drop Erodes the Market Share of Middle-class Joint Venture Brands

? Profits of New Car Sales for Luxury Car Dealers Decrease by 50%, and the Profits of the Medium and Large-sized Sedans Decrease by the Most

?In August, the Retail Market Continues to Maintain a Two-digit Growth,and Dealers of BMW, Audi and Jaguar Land Rover Continue to Clear Inventory

? In July the Luxury Car Retail Market Increased by 14.6% MoM, Dealers of BMW and Audi Clear the Inventory and Dealers of Mercedes-Benz Make Profits.

? Midyear inventory of Luxury Cars:The Sales Volume of 12 Luxury Car Brands Exceeds 1350,000 and Tariff Adjustment Leads to the Reduction of Import Volume of Luxury Cars by 18.3%.